These may interest you

Features & Benefits

- Open to individuals aged 18 years and above (available for single name or joint names).

- Placement and withdrawal can be made via HLB Connect.

- Account and placement details can be viewed upon successful placement.

- Interest payout upon maturity. Effective 01 January 2019, no interest shall be payable on partially withdrawn amount and/or premature withdrawal of eFD.

- Flexibility to make partial withdrawal and still earn interest on remaining balance (partial withdrawal must be in made in multiples of RM1,000)

- Maximum of two (2) account holders for Joint eFD with operating mandate of either one-to-sign.

Eligibility

- Minimum deposit of RM5,000 for 1 month placement or RM500 for 2 months and above.

- For individuals aged 18 years and above with Current Account/-i or Savings Account/-i.

- For Joint eFD, account holders must have a Current Account/-i or Savings Account/-i in the same names and operating mandate of either one-to-sign.

More details

Less details

- Minimum deposit of RM5,000 for 1 month placement or RM500 for 2 months and above.

- For individuals aged 18 years and above with Current Account/-i or Savings Account/-i.

- For Joint eFD, account holders must have a Current Account/-i or Savings Account/-i in the same names and operating mandate of either one-to-sign.

More details

Less details

Terms and Conditions apply.

Member of PIDM. Protected by PIDM up to RM250,000 for each depositor.

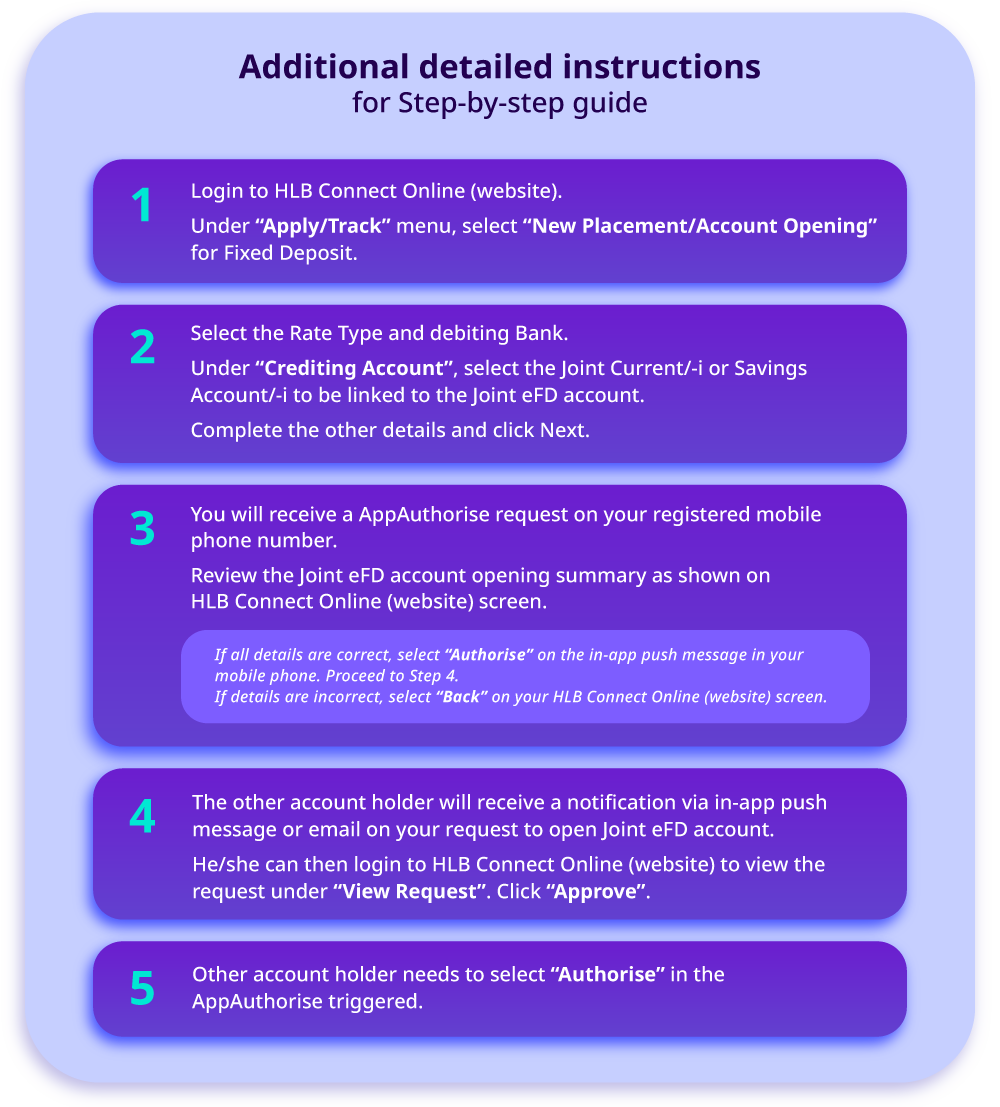

Joint eFD account is now available on HLB Connect Online (website) for two (2) account holders

with operating mandate of either one-to-sign.

Do you have an existing active Joint Current/-i or Savings Account/-i in the same names and operating mandate of either one-to-sign?

If yes, just follow our step-by-step guide below to open your Joint eFD account:

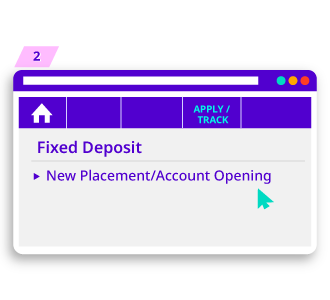

From the Apply menu, under Fixed Deposit,

select New Placement/Account Opening

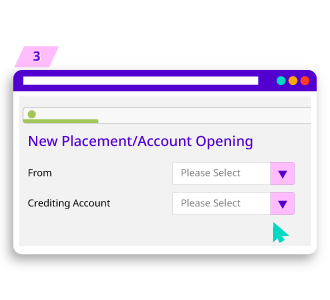

Under From, select your funding bank.

Under Crediting Account, select the Joint Savings or Current/-i Account

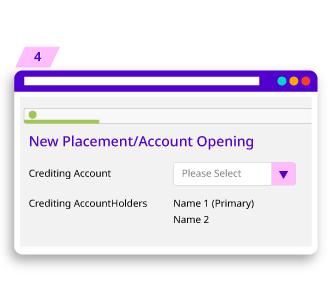

The account holders’ names for the selected joint Savings/-i or Current/-i account will be displayed.

Check that this is the correct account where you want to Principal and Interest to be credited

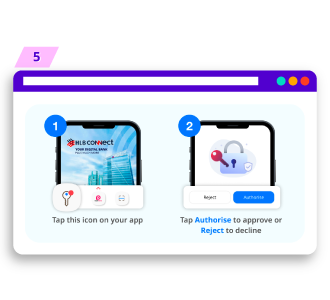

Click Next and authorize the request via AppAuthorise.

A notification will be sent to the other joint account holder to authorize the Joint eFD Account Opening

Inform the other account holder to login to HLB Connect Online (website) within 7 calendar days

Under HLB Connect Online (website), click on View Request & authorize the request via AppAuthorize

Need more details? See below

Start making placement when you receive the confirmation email from us that your Joint eFD account has been opened.

Terms and Conditions apply.

Member of PIDM. Protected by PIDM up to RM250,000 for each depositor.

| Tenure | Interest Rates (p.a.) |

|---|---|

| 1 month | 1.85% |

| 2 months | 2.25% |

| 3 months | 2.25% |

| 4 months | 2.30% |

| 5 months | 2.30% |

| 6 months | 2.30% |

| 7 months | 2.35% |

| 8 months | 2.35% |

| 9 months | 2.35% |

| 10 months | 2.35% |

| 11 months | 2.35% |

| 12 months | 2.35% |

| 13 - 60 months |

2.35% |

Important notice

Please click HERE for the exhaustive list of fees and charges.