HLB CONNECT FREQUENTLY ASKED QUESTIONS

Updated: August 2025

A. GENERAL

Q1. What is Hong Leong Connect / HLB Connect?

A1. Hong Leong Connect or HLB Connect is the digital banking services offered by HLB & HLISB (the Bank) for personal banking customers. The Bank offers HLB Connect Online banking services via internet browsers & HLB Connect App mobile banking services via smartphones and tablets.

HLB Connect is accessible 24 hours a day. However, there will be a short 15 minutes maintenance gap daily between 11.55pm - 12.10am where users will only be able to view account balance and make funds transfer to own HLB accounts or other Hong Leong accounts.

To learn more about HLB Connect features and services, please click this link:

https://www.hlb.com.my/en/personal-banking/hlb-connect.html

Q2. How do I get access to HLB Connect?

A2: To get access to HLB Connect, you have to register for Connect Account on HLB Connect Online banking website or on HLB Connect App. Please refer to Q1 in Section B for steps to register. Once you have registered for a Connect Account, the same username and password can be used on both HLB Connect Online and HLB Connect App.

Q3. Who is eligible to register for HLB Connect?

A3. All Hong Leong Bank Berhad (HLB) and Hong Leong Islamic Bank (HLISB) personal banking customers with an active account are eligible to register for HLB Connect

Q4. What is the minimum Internet web/mobile browser requirement for using HLB Connect Online?

A4. The following are the minimum browser requirements for using HLB Connect Online:

|

Type of Web/Mobile Browser |

Minimum Version for Desktop |

Minimum Version for Mobile |

|---|---|---|

|

Apple Safari |

16.3 and above |

16.3 and above |

|

Google Chrome Google Search App |

109 and above |

109 and above |

|

Samsung |

N/A |

21 and above |

|

MIUI Browser |

N/A |

18 and above |

|

Huawei Browser |

N/A |

14.0.4.300 and above |

|

Microsoft Edge |

112 and above |

112 and above |

|

Mozilla Firefox |

115 and above |

115 and above |

|

Vivo Browser |

N/A |

44.5.7.2 and above |

|

HeyTap |

N/A |

44.5.7.2 and above |

|

Opera |

101 and above |

101 and above |

Q5. What will happen if I am using an outdated Internet web/mobile browser or one that is not specified above to access HLB Connect Online?

A5. If your browser is outdated and incompatible with HLB Connect Online, you will be prompted to update to the latest version. You will be able to log in to HLB Connect Online once your browser is updated according to the table provided above.

Using the latest browser version helps to protect you from viruses, malware and other online threats. An updated browser also allows you to enjoy smoother browser performance and improved user experience.

Q6. How do I update my Internet web/mobile browser version?

A6. Here are some quick guides to update your browser:

- Google Chrome: Click on the three dots on the top right corner, select 'Help', then select 'About Google Chrome'. It will automatically check for updates and install them.

- Apple Safari: Open the App Store, go to 'Updates' tab and install any available updates.

- Mozilla Firefox: Click on the three lines on the top right corner, select 'Help', then select 'About Firefox'. It will automatically check for updates and install them.

- Microsoft Edge: Click on the three dots on the top right corner, select 'Help and feedback', 'About Microsoft Edge', then select 'Download and install’.

- Huawei: Open the Huawei AppGallery and search for 'Huawei Browser'. If an update is available, tap the 'Update' button to install the latest version.

Please refer to your respective browser providers for more in-depth guide.

Q7. Can I access HLB Connect from abroad?

A7. Yes, HLB Connect can be accessed from anywhere in the world as long as you have a computer terminal or personal electronic device with Internet connection and Internet browser or smartphones or Apple tablets with updated OS and active data service.

Q8. Is there any fee incurred when using HLB Connect?

A8. There is no fee for using HLB Connect Online / App. However, fees may apply to some banking services offered on HLB Connect such as online telegraphic transfer, eWill / eWasiat, mobile prepaid reload, Credit Card Quick Cash and etc.

Q9. What kind of security protection does the Bank provide to its customers who use HLB Connect?

A9. The bank has incorporated the following security features:

- Up to 256-bit encryption with 128-bit minimum enabled by SSL certificate to secure online transactions.

- 8-16 characters of alphabets and numbers Password for all HLB Connect customers.

- Temporary ID for registration or reset of HLB Connect.

- HLB Connect Code for registration and Device Activation Code for HLB Connect set up on device.

- AppAuthorise on HLB Connect App is required to authorise your transactions that used to require TAC.

- Security Picture is used to confirm that you are accessing the genuine HLB Connect Online / App.

- CAPTCHA validation is required after 2 consecutive unsuccessful login attempts on HLB Connect Online and/or App.

- HLB Connect Online will automatically log off if there is no activity performed within 5 minutes.

- Only one active session allowed at any given time. If you login to HLB Connect while you have another active session, the other session will be terminated.

- Your HLB Connect will be deactivated (becomes dormant) if you do not login for 12 months

- Your profile can be linked to only one HLB Connect App, installed on a single device at any given time. You can only log in using HLB Connect App that is linked to your profile

Q10. What is Debit / Credit Card PIN?

A10. PIN is a 6-digit personal identification number for your Debit / Credit Card.

Q11. What is a Temporary ID?

A11. It is an ID with 10 alphanumeric characters issued for HLB Connect registration. The Temporary ID will be sent to your email address registered with the bank. If you have not registered your email address with the bank, please visit HLB nearest branch to do so. For overseas customers, please call our Customer Service at +603-7626 8899 for assistance.

Q12. Is there a validity period for the Temporary ID issued to me?

A12. Yes, the validity period is 3 days.

Q13. How long will it take for me to receive the email confirmation for my Temporary ID if I am residing overseas?

A13. It will take up to 3 working days to process your request.

Q14. What is HLB Connect Code and what is the use it?

A14. It is a 6-digit unique security code that is required along with other verification methods for the following transactions / activities in HLB Connect:

- HLB Connect Registration and Reset

- Account settings and maintenance within HLB Connect

- Some online banking transactions within HLB Connect

Note: Please refer to FAQ on Transaction Authorisation for more details.

Q15. How to register or update my mobile number for HLB Connect Code?

A15. You may register or update your mobile number to receive HLB Connect Code by visiting any of our branches.

Note: For overseas customers, please call our Customer Service at +603-7626 8899

Q16: Where can I download the HLB Connect App from?

A16: You can download the Connect App from Apple App Store, Google Play Store or Huawei App Gallery. Search for ‘HLB Mobile Banking App’ or ‘Hong Leong Connect Malaysia’ to download. Huawei phone users should download the app from Huawei App Gallery instead of from Google Play Store.

Q17: Can I use the HLB Connect App on a tablet?

A17: You can use the Connect App on Apple iPads, but not on Android tablets.

Q18: What are the minimum device requirements to access the HLB Connect App?

A18: To access the app, your smartphone must be running on iOS 15 and above or Android/Huawei smartphones with OS 10 and above.

HLB Connect App does not work properly on jailbroken or rooted smartphones. You may check with the seller to ensure your device is not jailbroken or rooted.

B. HLB CONNECT REGISTRATION / RESET

Q1. How do I register for HLB Connect Online / App?

A1. You can register for HLB Connect Online via Internet browser at:

https://www.hongleongconnect.my

i. Before the registration, please ensure that:

a. You have registered your current mobile number to receive HLB Connect Code

b. You have registered your email address to receive Temporary ID

Note: If you have not updated your mobile number and email address with the bank, please visit any of our branches to do so.

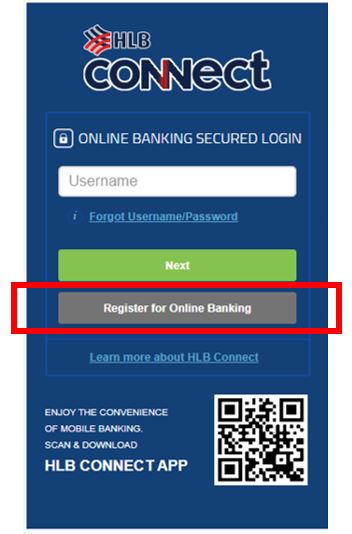

ii. Once ready, click on “Register for Online Banking" to begin.

Or you may also download and register via HLB Connect App. Simply scan the QR code on https://www.hongleongconnect.my to download the HLB Connect App and then tap on ‘Not Yet A Connect User?'

iii. Enter your ID number and the HLB Connect Code sent to your registered mobile number, then follow the steps to complete registration.

Q2. How do I login to HLB Connect Online / HLB Connect App?

A2. Please follow the below steps:

HLB Connect Online

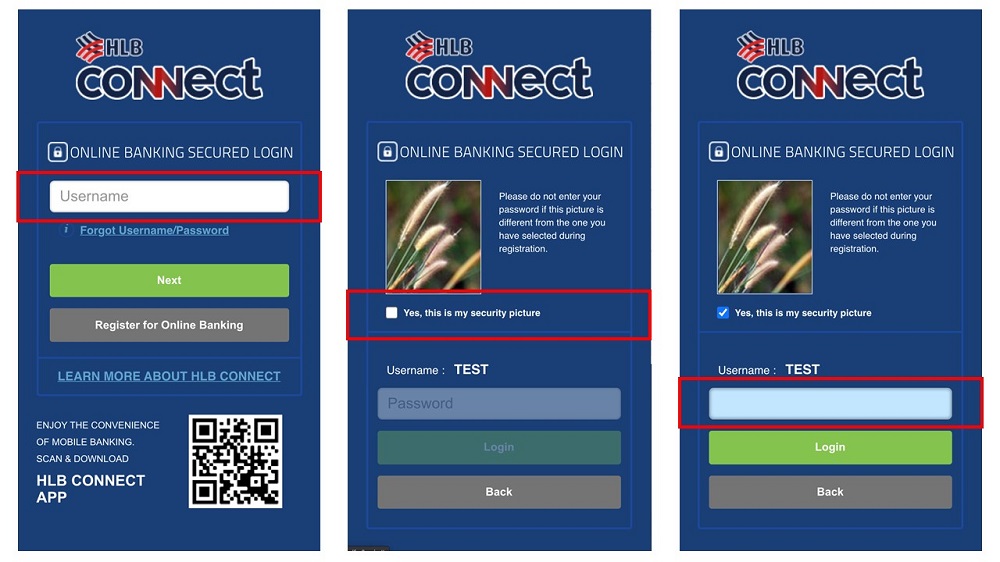

i. At https://www.hongleongconnect.my, enter your Username and click on the ‘Next’ button.

ii. The Password screen will be displayed. Click on the checkbox to acknowledge if your security picture is being displayed and then enter your Password. Always ensure that the correct security picture is displayed before you enter your Password.

iii. Click on the ‘Login’ button to proceed.

HLB Connect App

i. For first time login, you will need to enter your username. Tap in the box for ‘Yes, this is my security picture’ when you see the correct picture. Enter your password only if the correct security picture is shown to you.

ii. For subsequent login and if you have enabled biometric for your HLB Connect App, you can tap on the blue biometric button and log in using your Face ID or Fingerprint (this will only work if Face ID or Fingerprint authentication is available on your smartphone and you have enabled it).

iii. Alternatively, you can tap on the textfield that says ‘Login with Password’ and you will be brought to a screen where you will see your security picture. Enter your password only if the correct security picture is shown to you.

Q3. I forgot my Username / Password, what should I do?

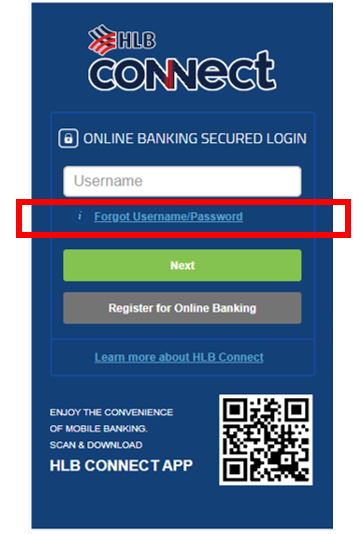

A3. You will need to reset your HLB Connect Username / Password using the steps below:

i. Please get ready the same details you’ve used during HLB Connect registration, refer to Q1 under Section B above for details.

ii. Visit Connect Online banking website at www.hongleongconnect.my

iii. Select “Forgot Username/Password” on Secured Login screen to reset:

For Existing HLB Connect App:

Enter your ID > enter HLB Connect Code > authenticate with AppAuthorise > enter Account/Card number and existing username for verification > enter your new password

For Non HLB Connect App Users:

Enter your ID > enter HLB Connect Code > Enter 10-character temporary ID sent via email > enter Account/Card number > enter your new password

Q4. Do I need to create a different set of Username and Password for HLB Connect App?

A4. No, you don’t need to. You can use the same username and password to login to both HLB Connect Online and HLB Connect App. The same security picture will also be shown during your login to both HLB Connect Online and HLB Connect App.

Q5. Can I change my HLB Connect Username / Password?

A5. Yes, you can change your username and password using the steps listed in Section B: Question 3. It is important to note that if you change your username, you will also have to change your password.

Q6. I can’t login to my HLB Connect Online / HLB Connect App. What should I do?

A6. This could be due to the following reasons:

i. You’ve entered a wrong password or username or both – please ensure you type the correct username and password as your Connect Account will be blocked after a few failed login attempts. It’s important to note that your password is case sensitive; if your password contains an uppercase but you’ve entered a lowercase instead, that will be considered as a wrong password.

OR

ii. You’ve not logged in for 12 months and your Connect Account has become dormant. In this case you will need to reset your Connect Account using steps listed in Section B: Q3

Q7. Why do I see a CAPTCHA validation when trying to login to my HLB Connect account?

A7. CAPTCHA validation is required after 2 consecutive unsuccessful login attempts on HLB Connect Online and/or App i.e. when you have entered wrong password twice consecutively. This is one of the safety measures put in place to safeguard our customers’ account. CAPTCHA is a function that helps tell a human and a bot apart and protects websites from spam and abuse.

Q8. How do I link / bind my Connect profile to a device?

A8. When you log in to Connect App on a device for the first time, you will automatically be prompted to bind your Connect profile to the device. Simply follow the steps to bind your device to your Connect profile.

Q9. I’m no longer using the device that I used to access HLB Connect App from, do I need to unlink / unbind my Connect profile from the device?

A9. Yes, you should unlink/unbind your Connect profile from the device to avoid unauthorised access to your account. To do so, simply log in to your Connect profile via HLB Connect App on the device linked/bound to your Connect profile. Tap on MENU > App Settings > Device & Notifications and tap on ‘Remove’ next to ‘Current Device’ to unlink / unbind.

Q10. What should I do if I suspect unauthorised access to my HLB Connect?

A10. If you suspect unauthorised access to your Connect Account, please do one of the following:

i. Click / tap on ‘Emergency Lock’ to prevent new transactions from your Connect.

ii. Call us as soon as possible at +603-7626 8899.

iii. Login to HLB Connect Online banking to change your Password. Select “Settings" > “Change Password” > “Reset Username/Password”

Q11. Why am I unable to log in to my account via HLB Connect App on someone else’s mobile device, why?

A11. That's because your Connect profile isn’t bound to the device where the HLB Connect App is installed. This is a security measure to protect your account from unauthorised access. HLB Connect App allows only one (1) Connect profile (username & password) to be bound to a device with HLB Connect App.

Q12: Why can’t I log in to my HLB Connect App after I’ve reset my Connect username/password? What should I do?

A12: It is likely because the app is no longer linked/bound to your profile. This happens after you’ve reset your Connect username. You need to first delete the app and re-install it before you log in using your new username. This will put you through the device binding process again.

Q13: I can’t seem to bind my Connect profile to the HLB Connect App in my device, why and what should I do?

A13: It is likely because your Connect profile is still bound to HLB Connect App on another device.

A Connect profile can only be bound to one device with HLB Connect App at any given time.

Here’s what you can do: Log in to the device that your Connect profile is currently bound to and remove that device from your Connect profile before you try to bind your Connect profile to the new device. To do this, please follow the steps in Q14, Section B.

If you do not have access to that device, please call us at +603-7626 8899 to remove the device from your Connect profile.

Q14: How do I remove my Connect profile from a device?

A14: Here’s how you can remove your Connect profile from a device:

1. Log in to HLB Connect App on the device is currently bound to.

2. Tap on Menu > App Settings > Devices & Notifications > tap on ‘Remove’ next to ‘Current Device’ to unbind.

If you do not have access to that device, please call us at +603-7626 8899 to remove the device from your Connect profile. A Connect profile can only be bound to one device with Connect App at any given time.

Q15: If I encounter bugs/issue when using the HLB Connect App, how do I report the issue/bug?

A15: Should you face any issues or come across any bugs when using the app, please send an email to HLOnline@hlbb.hongleong.com.my.

C. HLB CONNECT SERVICES / FEATURES

Q1. What Services / Features are available on HLB Connect?

A1: Please refer to the table below to see what are available on HLB Connect Online and HLB Connect App.

Note: User ages 12 to 17 (below 18) only has access to HLB Connect App and some services within the app.

| Services / Features

|

HLB Connect Online

|

HLB Connect App

|

Below 18 | |

|---|---|---|---|---|

|

1) |

Customise account(s) for Online viewing / transactions |

Yes |

Yes |

Yes |

|

2) |

Change Online transaction limits |

Yes |

Yes |

Yes |

|

3) |

Update Contact Information |

Yes |

Yes |

Yes |

|

4) |

Set Default Equivalent Currency |

Yes |

No |

No |

|

5) |

Declare Domestic Ringgit Borrowing |

Yes |

No |

No |

|

6) |

Change Password / Security Picture |

Yes |

No |

No |

|

7) |

Manage Favourites

|

Yes Yes Yes |

Yes Yes Yes |

Yes No Yes |

|

8) |

View

|

Yes

Yes Yes Yes Yes Yes No Yes Yes |

Yes

Yes Yes Yes Yes Yes Yes Yes Yes |

Yes

Yes No No No Yes Yes Yes Yes |

|

9) |

Transfer / Payment

|

Yes Yes Yes |

Yes Yes Yes |

Yes Yes Yes |

|

10) |

DuitNow

|

Yes No Yes Yes |

Yes Yes Yes Yes |

Yes Yes Yes Yes |

|

11) |

Reload

|

Yes Yes |

Yes No |

Yes No |

|

12) |

Telegraphic Transfer to other receiving Banks |

Yes |

No |

No |

|

13) |

Subscribe to email statement |

Yes |

No |

No |

|

14) |

Stop hardcopy statement |

Yes |

No |

No |

|

15) |

Online Fixed Deposit (eFixed Deposit/eFixed Deposit-i)

|

Yes

Yes |

Yes

No |

No

No |

|

16) |

Apply for and view application status for

|

Yes Yes Yes Yes Yes Yes |

No Yes Yes Yes No No |

No No No No No No

|

|

17) |

Investment Account-i

|

Yes Yes |

Yes No |

No No

|

|

18) |

Purchase Insurance and view status

|

Yes

|

Yes

|

No

|

|

19) |

Inquiry and Redemptions for

|

Yes Yes |

No No |

No No |

|

20) |

Debit Card Services

|

Yes

Yes Yes Yes Yes Yes |

No No No No Yes Yes |

No No No No No No |

|

21) |

Manage Cheque

|

Yes

|

No

|

No |

|

22) |

Credit Cards Services

*Only available in HLB Connect Online |

Yes

|

Yes

|

No |

|

23) |

HLeBroking

|

Yes |

No

|

No |

|

24) |

Pre-login Inbox

|

No |

Yes |

Yes |

|

25) |

AppAuthorise

|

No

|

Yes

|

Yes |

|

26) |

MACH

|

Yes

|

No |

No |

|

27) |

Investment Account for the following product groups:

|

Yes |

Yes

|

|

|

28) |

Foreign Currency Exchange

|

Yes No |

Yes Yes |

Yes Yes

|

|

29) |

Open funds transfer without authorisation. Note: Applicable for small transfer amounts. Default limit is RM250 for above 18 but you may customize your own limit at App Settings. |

No |

Yes |

No |

|

30) |

Bill Payment to billers / payee corporations within Malaysia

|

Yes No |

Yes Yes |

No No |

|

31) |

Connect ATM Withdrawal Cardless Cash withdrawal from HLB ATM

Notes: Your selected HLB / HLISB account will be earmarked for the amount to be withdrawn (“Earmarked Withdrawal Amount”). The Earmarked Withdrawal Amount will be released back to your selected HLB / HLISB banking account if not withdrawn within 1 (One) hour. Please do not share your ATM withdrawal code with unintended person. |

No

|

Yes |

|

|

32) |

QR Pay

|

Yes No |

Yes Yes |

Yes Yes |

|

33) |

HLB Connect App Linking / binding or unlinking / unbinding device from Connect Account |

No |

Yes

|

Yes |

|

34) |

Change preferred language: Bahasa Melayu, English, Chinese |

No |

Yes |

Yes |

|

35) |

Enrol or unenrol Fingerprint Authentication or Face Authentication |

No |

Yes |

Yes |

|

36) |

Push Notification Settings |

No |

Yes |

Yes |

|

37) |

ASNB

|

Yes |

No

|

No |

|

38) |

Foreign Currency Deposit

Note: Available to Pay&Save Account/-i and HLB Wallet+ Account/-i holders only. |

Yes Yes Yes

|

Yes Yes Yes

|

No No No

|

|

39) |

Pocket Connect

|

Yes |

No | No |

|

40) |

Share Margin Financing

|

Yes Yes Yes |

Yes Yes No |

No No No |

| 41) |

Services / Features : HLB Wealth

|

Yes | No | No |

| 42) | Request for copy of Mortgage/Property Financing-i security documents | Yes | No | No |

| 43) | Request to start early instalment for Mortgage/Property Financing-i interest/profit servicing account | Yes | No | No |

| 44) | Request to increase the amount for mortgage monthly instalment | Yes | No | No |

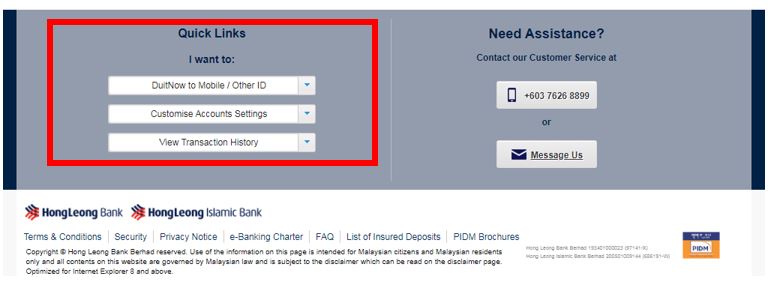

Q2. Is there a quicker way to navigate and access the common functions in HLB Connect Online?

A2. A quick way to navigate to and access common functions in HLB Connect Online is via the Quicklink. You can find the “Quick Link” section at the bottom of the page after login.

Q3. I am a registered HLB Connect user and own a Hong Leong supplementary credit card, why am I unable to view my supplementary credit card details via HLB Connect?

A3. That’s because only Hong Leong principle credit cardholder will have access to view the principle and supplementary credit card details via HLB Connect.

D. PAYMENTS & TRANSFERS

Own Account Transfer / Other Account Transfer / Bill Payment / Reload Services

Q1. What is ‘Recurring Transfer’ in HLB Connect Online?

A1. The ‘Recurring Transfer’ service is for customers who wish to repeat the same set of transaction on a Weekly, Bi-Weekly, Monthly, Quarterly, Half-Yearly, or Yearly basis. When you choose ‘Recurring Transfer’ for your transaction, you are making a Standing Instruction (SI) on HLB Connect.

Q2. What do I use ‘Manage Standing Instruction (SI)’ for?

A2. ‘Manage Standing Instruction (SI) feature is for customers who wish to ‘Copy’, ‘Skip’ or ‘Cancel’ the ‘Recurring Transfer’ that they have previously set up.

‘Copy’: to duplicate the transaction details of the respective SI for the purpose of setting another SI

‘Skip’: to skip the ‘Next Process Date’ of the respective SI

‘Cancel’: to cancel the remaining schedule of the respective SI

Q3. What are the key differences and the transfer schedule between 3rd Party HLB, IBG, DuitNow and DuitNow QR?

A3. The table below list down some key differences between the services and the transfer schedule:

|

Items |

Fund Transfer Services |

|||

|---|---|---|---|---|

|

3rd Party HLB |

InterBank GIRO (IBG) |

DuitNow QR / DuitNow To Account (Previously known as Instant Transfer) |

DuitNow To ID / Mobile |

|

|

Transfer Schedule

|

Immediate |

Refer to the table below |

Immediate (Subject to system availability of the beneficiary bank) |

|

|

Receiving banks |

HLB/HLISB |

All participating banks |

||

|

Receiving Bank Account Type |

Current / Savings, Credit Card, Loan / Financing accounts |

Current/ Savings Account |

||

|

Transfer Fee

|

(Not Applicable) |

RM0.00 per transfer* (effective 1 July 2018) |

RM0.00 per transfer* (*effective 1 July 2018) |

|

|

Eligibility |

HLB Connect users with HLB Current or Savings Account/-i |

|||

|

IBG FUNDS TRANSFER |

||||

|---|---|---|---|---|

|

Payment Initiated by Customers |

*Funds Received by Beneficiaries |

*Refund for Unsuccessful Transactions |

||

|

(on Business Days) |

Before 5:00am |

Same Business Day |

By 11:00am |

By 5:00pm |

|

5:01am to 8:00am |

By 2:00pm |

By 8:20pm |

||

|

8:01 to 11:00pm |

By 5:00pm |

By 11:00pm |

||

|

11:01am to 2:00pm |

By 8:20pm |

By 11:00am (Next Business Day) |

||

|

2:011pm to 5:00pm |

By 11:00pm |

|||

|

After 5:00pm |

Next Business Day |

By 11:00am |

By 5:00pm |

|

|

Saturday, Sunday and Federal Territory Public Holidays (Non- Business Days) |

Next Business Day |

By 11:00am |

By 5:00pm |

|

*Under normal circumstances

Beneficiaries will receive future-dated transfers by 11:00am on the selected date, or its next business day when the date falls on a weekend/Federal Territory public holiday.

Q4. Will I be able to receive the HLB Connect Code or Device Activation Code via my overseas mobile phone?

A4. Yes, you will be able to receive the code if you have registered your overseas mobile number with us.

Q5. Will recipients know the identity of the person(s) who transfer funds to them?

A5. Yes, the sender’s name as per the Identity Card / Passport will appear on the recipient's statement but other information such as the sender’s account number, bank name, IC or account balance, etc. will not be revealed to the recipients.

Q6. What kind of reload services are available via HLB Connect Online?

A6. Some of the reload services available on HLB Connect Online are Prepaid Mobile, Internet Access, Game Credit/Point and IDD & STD.

Q7. Will I get charged a fee for using Reload Services?

A7. No, you will not be charged any fee but applicable government taxes may apply.

Q8. What should I do if I do not see my reload PIN?

A8. If you do not see your reload PIN, you may try one of the following steps. Only applicable for HLB Connect Online.

1. For PIN-based reloads - Select "Pay & Transact" – “View History”. Click the reference number for the reload and you can retrieve your reload PIN in this page.

2. For Auto reloads – You will not get a PIN for this type of reload as it is not required. You are advised to check if the mobile number is reloaded. If the respective mobile number is not reloaded, you may call us at +603-7626 8899.

Q9. I have made a transaction for a wrong reload product. Can I cancel the transaction?

A9. Unfortunately, you will not be able to cancel your transaction if you have confirmed the transaction when prompted to.

Q10. Can I reload a 3rd party Junior Debit Card?

A10. No, currently you can only reload your own Junior Debit Card via HLB Connect Online.

Online Transactions History

Q11. Can I view the transactions history for my loan account via HLB Connect?

A11. Yes, you can. Just tap on your loan account box on HLB Connect App > tap on ‘Transactions’ OR click on loan account number in HLB Connect Online.

Q12. How many months of online transactions history performed via HLB Connect can I view?

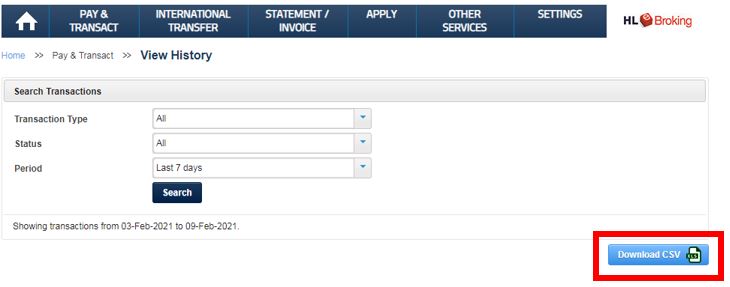

A12. You can view up to 120 days of online transactions history.

Q13. How can I view my past online transactions history?

A13. You can view your past online transactions by following the steps below:

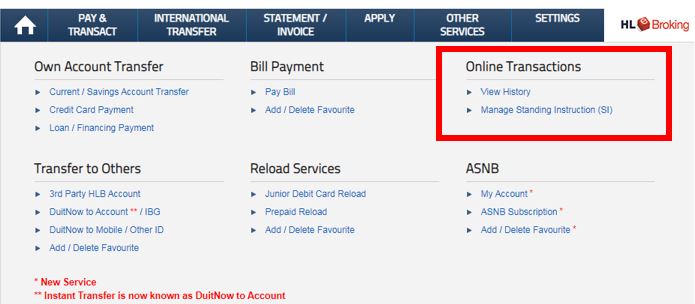

i. On HLB Connect Online – you can view and download into excel; Go to “Pay & Transact” >“Online Transactions” >“View History” >“Download CSV”

i. On HLB Connect App – you can only view transactions history; Tap on MENU > Activities > Search > Select ‘Transactions’ from the dropdown menu.

DuitNow

Q14. What is DuitNow?

A14. DuitNow is a service that enables you to transfer money instantly to your recipients’ DuitNow ID or account number.

Q15. What are DuitNow IDs and how do I register them?

A15. The following are DuitNow IDs. You can register one or more of these ID’s by linking them to your Hong Leong Bank current or savings account. One ID can only be linked to one current or savings account.

i. Mobile Number

ii. NRIC Number

iii. Passport Number (for non-Malaysian citizens)

iv. Business Registration Number (for businesses)

Q16. How do I register my DuitNow ID to receive funds from others?

A16. Here are how:

- HLB Connect Online: Go to “Settings” > “DuitNow”. Then register your DuitNow ID (Mobile No or NRIC) with your Hong Leong Bank current/savings account/-i

- HLB Connect App: Tap on MENU > Account Settings & Limits > Manage DuitNow ID

Q17. How do I send and receive money using DuitNow IDs?

A17. Here are the steps to send and receive money using DuitNow:

a) To send DuitNow:

- HLB Connect Online: Select from main menu, or under ‘Pay & Transact”, enter the recipients DuitNow ID and other transaction details

- HLB Connect App: Tap on DuitNow logo on the login screen or log in and tap on MENU > Transfer > New Transfer > tap on Mobile Number / NRIC Number / Passport Number / Business Registration Number

b) To receive DuitNow: Register your DuitNow ID (Mobile Number / IC Number / Passport Number / Business Registration Number) with your HLB current/savings account/-i and provide the sender with your DuitNow ID.

Q18. Can I link my DuitNow ID to more than one account?

A18. No, you can’t. Each ID can only be registered with one bank account at a time.

Q19. Can I change my DuitNow ID registration details?

A19. Yes, you can. Just follow the steps below:

- HLB Connect Online: Click on ‘Settings’ > ‘Update DuitNow ID’

- HLB Connect App: Tap on MENU > ‘Account Settings & Limits’ > Manage DuitNow ID

Q20. Can I schedule a future-dated or recurring DuitNow transfer?

A20. Yes, you can schedule DuitNow transfers using the following steps:

- HLB Connect Online: Click on ‘Pay & Transact’ > DuitNow to Account or DuitNow to Mobile / Other ID > Fill in transfer details > Select One Time Transfer / Recurring Transfer > input the start date for the transfer.

- HLB Connect App: Tap MENU > tap on Transfer > New Transfer > tap on Mobile Number/IC Number/ Passport Number / Business Registration > enter mobile number & select the ‘Recipient Reference’ from drop down and tap ‘Next’ > enter transfer amount > in ‘Other Details’ screen, select your payment date and then select “Recurring Payment’ if you wish to repeat this payment

Q21. Can I save DuitNow ID’s as a Favourite recipient and how can I do that?

A21. Yes, you can add DuitNow recipients to your favourites list in HLB Connect Online and HLB Connect App. Here are how:

- HLB Connect Online: Click on ‘Pay & Transacts’ > under ‘Transfers to Others’ click on ‘Add/Delete Favourite’

- HLB Connect App: Tap on MENU > tap on ‘Add / Delete Favourites’ > tap on Mobile /Other IDs > select the ID you want to add as favourite from the dropdown

Q22. Is there a transfer limit for DuitNow?

A22. Yes, there’s a daily transfer limit. You can transfer a combined total of up to RM50,000 per day when sending money to other HLB accounts (3rd Party HLB) or to accounts in other banks (Interbank GIRO (IBG) and DuitNow). You can adjust these daily limits by using these steps:

- HLB Connect Online: Click ‘Settings’ > ‘Change Online Transaction Limits’

- HLB Connect App: Tap ‘Menu’ > ‘Account Settings & Limits’ > ‘Transaction Limits’ > ‘Transfer’

Q23. Are there any fees or charges for DuitNow transfers?

A23. No, there are no fee or charges for DuitNow transfer in HLB Connect.

Overseas Transfer

Only available on HLB Connect Online

Q24. What is an Overseas Transfer (OT)?

A24. OT is a digital remittance service to send money / transfer funds overseas in foreign currencies to correspondent banks/agents outside Malaysia via HLB Connect Online. A cash pickup option of the transferred funds from participating partner agents (without going through a bank account) is also available for some countries.

Q25. Who is eligible to perform an OT?

A25. OT is open to all HLB Connect users who need to send money overseas.

Q26. What is the maximum transaction amount per day for OT?

A26 Your maximum transaction amount is up to RM200,000 per day either within a single transaction or from multiple transactions. You can set your own daily limit in HLB Connect Online at ‘Settings’ > ‘Change Online Transaction Limits’. However, each transaction has its own limit depending on your:

- Resident status

- Daily online transaction limit settings

- Purpose of transfer

Q27. When can I perform an OT?

A27. You may perform an OT at any time. Transfers will be processed instantly or up to 2 business days subject to the transfer amount, the receiving countries and the payout partners.

Q28. How long will it take for the recipient to receive the funds?

A28. The funds will be received instantly or up to 2 business days subject to the transfer amount, receiving countries and payout partners.

Q29. Can I cancel an OT after I have successfully submitted it?

A29. If you need to cancel and OT after you have successfully submitted it, please reach us via one of these channels:

- Email to HLOnline@hlbb.hongleong.com.my

- Call our Customer Service at +603-7626 8899

- Go to any of our Hong Leong Bank branches

Important:

Upon successful cancellation, only the principal transfer amount will be refunded. The associated fees to facilitate the transfer and potential foreign exchange losses will not be refunded.

Refunds shall be made only in Ringgit Malaysia (“RM”) and if the funds are in foreign currency, such funds will be converted to RM at the Bank’s buying rate for such foreign currency at the time of refund (less any cost, interest, charges and expenses resulting from such currency conversion).

FPX and DuitNow Online Banking/Wallets

Q30: What is the difference between FPX and DuitNow Online Banking/Wallets (DuitNow OBW)?

A30: Both are payment methods that allow customers to complete online payment transactions and pay using their CASA/CASA-i or Credit Card (available for selected Merchants/Billers) via HLB Connect. Depending on which services the Merchant/Biller subscribed to, you will either see an FPX or a DuitNow OBW screen when making a payment.

When making payment using FPX or DuitNow OBW, you will be directed to HLB Connect login page from the merchant payment page. You will need to log in using your HLB Connect credentials and complete the transaction by authorising it using AppAuthorise before returning to the merchant’s page.

Q31: What are the online transaction limits for HLB Connect?

A31: The maximum limits for online transactions on HLB Connect are as below. These limits are for combined transactions from HLB Connect Online and HLB Connect App. You can always set a lower daily limit that you are comfortable with.

Note: For users aged 12 to 17, the online transaction limit is RM 200 daily.

| Combined Daily Limit | Transaction Types | Daily Limit for 18 and above | Daily Limit for Below 18 |

|---|---|---|---|

|

For 18 years old and above: the maximum combined value from all these transactions types is RM50,000 daily.

For below 18 years old: the maximum combined value from all these transactions types is RM200 daily. |

FPX Merchant Specific | RM50,000 | Not applicable |

| FPX Non-Merchant Specific | RM30,000 | Not applicable | |

| DuitNow Online Banking/Wallets | RM50,000 | Not applicable | |

| Connect ATM Withdrawal | RM1,500 | RM100 | |

| Prepaid Reload | RM200 | RM100 | |

| Junior Debit Card Reload | RM5,000 | Not applicable | |

|

For 18 years old and above: the maximum combined value from all these transactions types is RM50,000 daily.

|

QR Payment (within Malaysia) Maximum daily limit for QR Pay is RM10,000. You can also set your own daily limit to make QR payments without authentication of up to RM250. However, authentication in the form of Password or Biometric (Fingerprint/Face ID), together with AppAuthorise will be required when you exceed the limit you’ve set. |

RM10,000

|

RM200 |

|

Cross-Border QR

|

RM10,000 | RM200 | |

| Third Party HLB Account | RM50,000 | RM200 | |

| Transfer to Other Banks (via DuitNow or Interbank GIRO (IBG)) | RM50,000 | RM200 | |

| The maximum combined value from all these transactions types is RM50,000 daily. | Bill Payment | RM50,000 | Not applicable |

| Other Retail Payment (non-FPX or non-DuitNow Online Banking/Wallets) | RM30,000 | Not applicable | |

| The maximum combined value from all these transactions types is RM50,000 daily. | ASNB Subscription to Own/Minor Account | RM50,000 | Not applicable |

| ASNB Subscription to 3rd Party Account | RM25,000 | Not applicable | |

|

Overseas Transfer The transfer limit for single transaction varies according to your resident status, relationship with recipient and the purpose of transfer.

|

RM200,000 | Not applicable | |

| HLE Broking Transfer | RM1,000,000 | Not applicable |

E. TRANSACTIONS AUTHORISATION & VERIFICATION

All transactions on HLB Connect that used to require SMS TAC now has to be authorised using AppAuthorise.

AppAuthorise

Q1. What is AppAuthorise?

A1. AppAuthorise is a convenient and secure way to authorise your HLB Connect Online and/or HLB Connect App transactions/functions that used to require SMS TAC. This is part of our continuous efforts to further safeguard your online banking security against fraud, in line with the industry direction to combat financial scams.

If you are an HLB Connect App user, AppAuthorise is the only option available for you to authorise your transactions/functions listed in Q3 below.

If you are an HLB Connect Online user without the app, you will need to download HLB Connect App and enable AppAuthorise.

Q2. How do I use AppAuthorise?

A2. When you initiate any HLB Connect transactions/functions listed in Q3 below, you will receive a notification on your HLB Connect App.

All you need to do is tap on the notification and you will be shown a screen with transaction details and two buttons; Authorise and Reject. Tap on ‘Authorise’ if you wish to proceed with that transaction. Tap on ‘Reject’ if you wish to cancel the transaction.

If you did not receive the notification, simply tap on AppAuthorise icon at the app’s login screen to get to the AppAuthorise screen.

Q3. When do I need to use AppAuthorise?

A3. AppAuthorise is required for the following transactions/functions. However, these are not an exhaustive list of transactions that requires AppAuthorise.

i) Transactions (above RM10,000)

-

Transfer to your own HLB account e.g. Bank Account, Credit Card, Loan/Financing-i

-

Transfer to your favourite Recipient/Biller via 3rd Party Transfer, IBG, DuitNow to Account, DuitNow to Proxy & Bill Payment

-

Currency conversion via Multi-Currency Feature

-

e-Fixed Deposit/-i Placement

-

Unit Trust/Investment Account-i Subscription & Top-up

ii) Transactions/Functions (no min. amount)

-

Non Favourite Transfer to a 3rd Party HLB Account

-

Non Favourite Transfer via IBG/DuitNow to Account/DuitNow to Mobile or Other ID

-

Non Favourite Bill Payment

-

FPX (DuitNow Online Banking/Wallets)

-

Non Favourite Prepaid Reload

-

Overseas Transfer

-

QR Pay

-

ASNB Subscription

-

eFixed Deposit/-i Withdrawals

-

Unit Trust/Investment Account-i Redemption

-

Manage Standing Instruction (SI)

-

Credit Card portfolio application i.e. Balance Transfer/Quick Cash/Flexi Payment Plan

-

Debit/ATM Card Services i.e. Card Transactions Limit, Card Feature Settings, Report Lost/Stolen Card & Fraud and Link Accounts

-

Credit Card Services i.e. Request Increase in Credit Limit, Request Card Replacement, Report Lost/Stolen Card & Fraud

-

Customise Account (View & Transact)

-

Update Contact Info (Credit Cards, Deposit Account)

-

Adding Favourite Account/Biller/DuitNow Proxy ID e.g. Mobile/NRIC number, etc

Q4. How do I enable AppAuthorise?

A4. Here are the steps to enable AppAuthorise:

A) If you are an existing HLB Connect user and downloading HLB Connect App for the first time, you are required to link/bind your mobile device to HLB Connect App.

- Log in to HLB Connect App using your HLB Connect Username and Password. Please ensure you are shown the correct Security Picture before you enter your Password

- For verification, you will be asked to enter your HLB Connect Code (this will be sent via SMS to your mobile number), ID number (NRIC/Passport/Business Registration Number) and Device Activation Code (this will be sent to your email address).

- Once you have provided all the details, your mobile device will be linked/bound to your HLB Connect App. AppAuthorise will automatically be enabled on your HLB Connect App after the 12-hours Cooling-Off Period.

B) If you are registering for HLB Connect for the first time, we recommend that you download HLB Connect App first so that you can do two things on the app (i) Register for HLB Connect and (ii) Enable AppAuthorise.

Q5. Can I enable AppAuthorise on multiple devices?

A5. No, you can only enable AppAuthorise on ONE device as HLB Connect App is only allowed on one device per HLB Connect profile at any given time.

If you wish to move AppAuthorise to another device, you will have to unbind/unlink your HLB Connect profile from the current device first then log in to set up the app on the new device and perform binding process. AppAuthorise will be enabled as part of the app journey.

Here are steps to unlink/unbind device: Tap 'Menu' > 'App Settings' > 'Device & Notification' > 'Remove'

Under Review

Q6. I just received a notification stating that my transaction is “Under Review”, what does this mean?

A6. When we detect a suspicious, out of the ordinary or possibly fraudulent transaction, it will be put under review pending further verification. It is an added security feature implemented to protect all transactions performed via HLB Connect Online.

Q7. What constitutes a suspicious transaction?

A7. Based on your past transaction history and patterns, we will monitor for any future transactions that appear unusual or out of the ordinary.

Q8. What happens if a transaction I make is deemed suspicious?

A8. Transactions that are deemed suspicious will be put on hold pending further verification. You will receive a notification that your transaction is “Under Review”.

Q9. How long will my payment/transfer be “Under Review”?

A9. This will depend on your scenario,

The Bank may call you for a verification. Once the verification is complete, the payment/transfer will be released within one (1) hour. You will receive a notification on your HLB Connect App or to your email address registered with the Bank.

If the Bank cannot reach you, for your safety, your access to HLB Connect will be locked, and the payment/transfer will be held.

Please call us at 03-7626 8899 using the contact number you have registered with the Bank to unlock your access to HLB Connect and to confirm and release the payment/transfer. Otherwise, the amount will be released back to your account within six (6) hours.

If you need to update your registered contact number with the Bank, our HLB Contact Centre will advise the next course of action for further verification.

Scenario 2:

If a call verification is not required, your payment/transfer will be released within one (1) hour.

Q10. How will I know if my transaction has either gone through or failed?

A10. You will receive a notification on your HLB Connect App or to your email address registered with the Bank. Alternatively, you can check the status of your payment/transfer on HLB Connect using the following steps:

On HLB Connect App:

Tap 'Menu' > Tap 'Activities' & you'll see a 'Successful' status for that transaction

On HLB Connect Online:

Click 'Pay & Transact' & click 'View History' under 'Other Transactions'

F. OTHER SERVICES

Q1: What are services available for Debit Card in HLB Connect?

A1: These are services available for Debit Card on HLB Connect:

Only Available On HLB Connect Online

A. Apply for Debit Card (applicable for active current and saving account customers who do not have debit card). Steps: APPLY > Debit Card

B. Debit Card Activation (for customers who have just received a new debit card). Steps: OTHER SERVICES > Activate Card (under Debit / ATM Card) OR Click on ‘Active and set PIN’ link below your account details. You will be required to enter details from your physical Debit Card, confirm your Debit Card settings and enter HLB Connect Code to complete your Debit Card activation.

C. Debit Card Renewal (applicable for customers with Debit Card expiring in 3 month’s time). Steps: Click on the ‘Renew now’ link below your account details.

D. Set Debit Card Transaction limit. Steps: OTHER SERVICES > Card Transaction Limit (under Debit / ATM Card).

E. Reset Forgotten PIN: This function allows you to reset or uplift blocked Credit Card/ Debit Card 6-digit PIN via HLB Connect online. Steps: OTHER SERVICE > Reset Forgotten PIN (under ‘Debit / ATM Card).

Available On Both HLB Connect Online & App

F. Change ATM Withdrawal / Transfer Limit’: This function allows you to set or change your ATM Withdrawal limit as well as your ATM transfer limit. Here are the steps:

- HLB Connect Online: OTHER SERVICES > Card Transaction Limit (under Debit / ATM Card).

- HLB Connect App: MENU > Account Settings & Limits > ATM Withdrawal Setting

G. Change Retail / Online Purchase Limit: This function allows you to set or change the maximum amount you allow to be debited from your HLB Current / Savings account when using your Debit Card for retail purchases at merchant outlets and for purchases made on the Internet. Here are the steps:

- HLB Connect Online: OTHER SERVICES > Change Retail / Online Purchase Limit (under Debit / ATM Card).

- HLB Connect App: MENU > Account Settings & Limits > Transaction Limits > Payment

H. Change Overseas Withdrawal and Debit Card Settings: This function allows you to enable other services offered by your ATM / Debit Card as follows:

a) Mail / Telephone Order (MOTO) and Auto Debit;

b) Overseas ATM Withdrawal**;

c) Overseas Retail Purchases**; and

d) Non-3D Internet Purchases (these are purchases where the online merchants do not require OTP (One Time Password).

**For added security, we encourage you to disable these services once you return home from overseas.

Here are the steps:

- HLB Connect Online: OTHER SERVICES > Change Overseas Withdrawal and Debit Card Settings (under Debit / ATM Card).

- HLB Connect App: MENU > Account Settings & Limits > Transaction Limits > Transfer

I. Report Lost/ Stolen Card & Fraud: This function allows you to send an instant report to the bank via Connect Online for your Lost / Stolen debit card or if you suspect fraudulent activities on your debit card. Here are the steps:

- HLB Connect Online: OTHER SERVICES > Report Lost/ Stolen Card & Fraud (under Debit / ATM Card).

- HLB Connect App: Tap on current / savings account box > SERVICES

Q2: What are the services available for Credit Card in HLB Connect?

A2: These are services available for Credit Card in HLB Connect:

Only Available On HLB Connect Online

A. Reset Forgotten PIN: This function allows you to reset or uplift your blocked Credit Card’s 6-digit PIN. Here are the steps:

OTHER SERVICES > Reset Forgotten PIN (under ‘Credit Card’).

B. Activate Card: This function allows you to activate your new credit card. You can activate your credit card after it’s been approved even before you receive your physical credit card and start using it for online purchases.

Please refer to Q3 to Q15 under Section E: Other Services on Online Purchase Activation for details. Important: even after you have activated your card for online purchases, you will still need to activate your physical credit card after you receive it in order to be able to use it for other transactions. Here are the steps:

OTHER SERVICES > Activate Card (under ‘Credit Card’).

C. Inquire / Redeem Rewards Points: This function allows you to check your credit card rewards points and redeem a reward using your points via Connect Online. Here are the steps:

OTHER SERVICES > Inquire / Redeem Rewards Points (under ‘Credit Card’).

D. Redeem Fortune Credit Card Rewards: This function allows you to check your Fortune credit card rewards points and redeem a rewards using that points. Here are the steps:

OTHER SERVICES > Redeem Fortune Credit Card Rewards (under ‘Credit Card’).

E. Request refund for outstanding balance overpayment: This function allows you to get back the extra money that you have accidentally paid towards your credit card.

F. Temporarily Freeze / Unfreeze Card: This function allows you (as the cardholder) to temporarily freeze your card. This feature is convenient in scenarios when you have misplaced or couldn’t locate your card but unsure if you have lost your card. Once you have your card back, simply Unfreeze the card and you can instantly use it as usual. Here are the steps:

Click on your card numbers to get to the card overview page > Click on ‘Freeze card’

If your card is already frozen, simply follow the same steps but click on ‘Unfreeze Card’

Available On both HLB Connect Online & App

G. Request Card Replacement: This function allows you to request for card replacement via HLB Connect Online. Here are the steps:

- HLB Connect Online: OTHER SERVICES > Request Card Replacement (under ‘Credit Card’).

- HLB Connect App: Tap on credit card box > SERVICES > Request Card Replacement.

H. Report Lost/ Stolen Card & Fraud: This function allows you to send instant report to the bank via HLB Connect for your lost/stolen credit card or if you suspect fraudulent activities on your credit card. Here are the steps:

- HLB Connect Online: OTHER SERVICES > Report Lost/ Stolen Card & Fraud (under Credit Card).

- HLB Connect App: Tap on credit card box > SERVICES > Report Lost/ Stolen Card & Fraud.

I. Notify Overseas Travel: This function allows you to notify the bank of your impending overseas travel and card usage plan. Here are the steps:

- HLB Connect Online: OTHER SERVICES > Notify Overseas Travel (under Credit Card).

- HLB Connect App: Tap on credit card box > SERVICES > Notify Overseas Travel.

J. Request Increase in Credit Limit: This function allows you to request for a temporary or permanent increase in your credit limit. Here are the steps:

- HLB Connect Online: OTHER SERVICES > Request Increase in Credit Limit (under Credit Card).

- HLB Connect App: Tap on credit card box > SERVICES > Permanent Increase Limit / Temporary Increase Limit.

Online Purchase Activation for Credit Card

Q3. What is online purchase activation on HLB Connect?

A3: Online purchase activation is a HLB Connect feature that allows Connect users to use their new credit card for online purchase immediately after their application is approved and while waiting for their physical card to arrive.

Q4. When can I activate my credit card for online purchases?

A4: Once your card is approved, your virtual credit card will appear in HLB Connect Online and App. You may activate the card and start using it for online purchases.

Q5. How do I activate my credit card for online purchases?

A5. Here are the steps to activate your newly approved credit card:

a) HLB Connect Online: Click on the credit card list at Account Overview page > click on the Online Purchase Activation button below the card image.

b) HLB Connect App: Swipe left to your credit card screen > tap on the Credit Card that you want to activate > follow the instructions to proceed

Q6. Once activated for online purchase, can I use my credit card for purchases in physical store?

A6: No, you can only use your card to make online purchases. Purchases at physical store will require you to swipe or tap your physical card to make payment.

Q7. Are the details (card’s number, expiry date and CVV) displayed virtually on my credit card on HLB Connect the same as the details on the physical card that I will receive?

A7: Yes, the details on your virtual card and physical card are the same.

Q8. Will I still see my credit card details in HLB Connect after I receive my physical credit card?

A8: Yes. It will be there for as long as your card is active.

Q9. Can I deactivate my credit card for online purchases after I’ve activated it?

A9: No, you can’t deactivate once you have activated online purchases for the card.

Q10. After I’ve activated my credit card for online purchases, do I still have to activate my physical card when I get it?

A10: Yes, you will still need to activate the physical card via HLB Connect Online / HLB Connect App once you’ve received it. Once activated the physical card can be used for both online and physical store purchases.

Q11. Can I activate my credit card for online purchases via other means without using Connect?

A11: No, you can’t. This is a feature made available for the benefit of HLB Connect users and therefore can only be activated via HLB Connect.

Q12. Can I activate my supplementary credit card for online purchases before I receive the physical card?

A12: No. Activation of card for online purchases is only available for principal cards.

Q13. Is there a limit to how much I can spend on my virtual card after I’ve activated it for online purchases?

A13: The limit follows your credit card’s credit limit. For example: if your approved credit limit is RM100,000 then you can spend up to RM100,000.

Q14. Can I make my bill payments online once I’ve activated my credit card for online purchases?

A14: No, you can only use the card on e-commerce sites.

Cheque Services

Only available on HLB Connect Online

Q15. What are the features / functions available for Cheque and how do I access them on HLB Connect Online?

A15. These are features/functions available for Cheque

i. Cheque Status Inquiry: This function allows you to check if the cheque you issued has been cashed out. To access this function, click on ‘Other Services’ and click on ‘Cheque Status Inquiry’ under other Services

ii. Cheque Book Request: This function allows you to request for cheque book via HLB Connect Online. To access this function, click on ‘Other Services’ and click on ‘Cheque Book Request’ under ‘Cheque’

iii. Stop Cheque \ Request: This function allows you to stop cashing out of cheque that has been issued from your cheque book. To access this function, click on ‘Other Services’, click on ‘Stop Cheque Request’ under ‘Cheque’

Direct Debit Instruction / Mandate

Only available on HLB Connect Online

Q16. What is a Direct Debit Instruction / Mandate?

A16. Direct Debit Instruction / Mandate displays the lists and statuses of Direct Debit Mandate instruction you have given to the Bank to collect / debit the amount as billed by the biller directly from your account.

Q17. What do these statuses mean: Successful, Rejected, Terminated or Expired?

A17. Status of your successfully processed Direct Debit Mandate is reflected / displayed here. Please contact the biller/ merchant if the status displayed is not according to the Direct Debit instruction you have made.

Q18. What should I do if my Direct Debit Mandate status is incorrect?

A18. Please call us at +603-7626 8899 and we will investigate the issue for you.

Q19. Where do I apply for Direct Debit Mandate?

A19. You may apply for Direct Debit Mandate from the biller/merchant that you wish to make Direct Debit payment to.

Q20. Where do I terminate my Direct Debit Mandate?

A20. You may terminate the Direct Debit Mandate with the biller / merchant that you have been making Direct Debit payment to.

Statement / Invoice

Only available on HLB Connect Online

Q21. Can I request to receive for e-statement via email?

A21. Yes, you can. You can download the e-statements to your computer or have them sent to you via your email in HLB Connect Online. Go to “Statement / Invoice” > “Online Statement”

Foreign Currency Deposit

Available on both HLB Connect Online & App

Q22. What is Foreign Currency Deposit?

A22. This is a feature that allows customers (single account holders) to keep up to 12 Foreign Currencies in their Hong Leong Pay&Save/ Pay&Save-i Account or HLB Wallet account.

Q23. What currencies are available within this feature?

A23. The currencies available are as follows:

|

Table 1 |

|

|---|---|

|

Singaporean Dollar (SGD) |

Chinese Renminbi (CNH) |

|

New Zealand Dollar (NZD) |

Thai Baht (THB) |

|

Hong Kong Dollar (HKD) |

Japanese Yen (JPY) |

|

US Dollar (USD) |

Euro (EUR) |

|

Australian Dollar (AUD) |

Pound Sterling (GBP) |

|

Saudi Arabian Riyal (SAR) |

Canadian Dollar (CAD) |

Q24. What are the benefits of this feature?

A24. With this feature, you can do the following:

a) Perform instant currency conversion between MYR and any other 12 currencies within your Pay&Save/ Pay&Save-i account or HLB Wallet.

b) Set alerts to get notified via HLB Connect Inbox or HLB Connect app notification when your preferred foreign exchange rate becomes available.

c) Spend at retail outlets and withdraw cash at ATMs overseas from the foreign currency held in your Pay&Save/ Pay&Save-i or HLB Wallet using the debit card linked to your account (this is not available for Chinese Renminbi [CNH])

Q25. I have an existing Foreign Currency Account. How do I take advantage of foreign currency deposit?

A25. This feature is available for Pay&Save/Pay&Save-i & HLB Wallet accounts only. You may choose to transfer all the funds under your Foreign Currency Account to your Pay&Save account and then perform a currency conversion. This will enable you to conveniently maintain all eligible foreign currencies under one single account.

Q26. Can I still maintain my existing Foreign Currency Account when I’m using Foreign Currency Deposit?

A26. Yes, you can still maintain your existing Foreign Currency Account. However, the features available in Foreign Currency Deposit is not available for your Foreign Currency Account.

Q27. Will I be able to see my foreign currencies in my Pay&Save/ Pay&Save-i account in HLB Connect App?

A27. Yes, you are able to.

Q28. Do I need different debit cards for different currencies that I have deposited in my Pay&Save/Pay&Save-i or HLB Wallet account?

A28: No, you only need one debit card linked to your Pay&Save/ Pay&Save-i account.

Q29. Can I perform currency conversion without converting back to MYR, e.g. convert directly from SGD to HKD?

A29. Yes, you can. You can perform cross-currency conversion on HLB Connect within the Pay&Save/ Pay&Save-i or HLB Wallet account with all currencies available with this feature.

Q30. If I spend / withdraw Australian Dollar (AUD) in Australia, which currency will be deducted from my account?

A30. There will be two possibilities based on these scenarios:

a) Scenario 1: If your account has enough balance of AUD then the amount will be deducted from the AUD balance in your account.

b) Scenario 2: If your account does not have enough balance of AUD/ no AUD at all, then the amount will be deducted by default from the MYR balance in your account (foreign exchange rate applies).

Q31. Can I spend / withdraw all currencies available while I’m overseas?

A31. Yes, you can, except for Chinese Renminbi (CNH). Chinese Renminbi (CNH) is not available for overseas spend and withdrawal.

Q32. Do I use the same Debit Card for overseas spend/ withdrawal as the one I use in Malaysia?

A32. Yes, you can use the same Debit Card for your overseas spend and withdrawal. To use this feature, please remember to enable overseas spending and withdrawal before you travel. Here's how:

- HLB Connect App: Tap on your Pay & Save/i or HLB Wallet account box > tap on Services > tap on Debit Card Settings > Toggle right to enable ‘Overseas Retail Purchase’ and ‘Overseas Withdrawal’

- HLB Connect Online: Click on ‘Other Services’ > click on ‘Debit/ATM Card’ > click on ‘Card Settings’ > click on ‘Overseas Retail Purchase’ > click on ‘Overseas Withdrawal’

Q33. Are there any fees/charges for overseas withdrawals?

A33 Yes, there’s a withdrawal fee for all overseas withdrawals, which is RM12 (in Fixed Equivalent Foreign Currency) or 2% of the withdrawal amount, whichever is higher.

List of Fixed Equivalent Foreign Currency:

- AUD 4.50

- EUR 3.00

- HKD 25.00

- JPY 350

- NZD 5.00

- GBP 2.50

- SAR 12.00

- SGD 4.00

- THB 100

- USD 3.00

Note: Some overseas ATM imposes an additional access fee for using their ATM machine and the fees are subject to the respective ATM that you are using.

Q34. Are there any foreign currency conversion fees charged on overseas retail spend?

A34. No, there is no foreign currency conversion fee on overseas retail spend provided that you have sufficient funds in the said currency account within your Pay&Save/ Pay&Save-i or HLB Wallet Account. If there are insufficient funds in the said currency account to pay for the purchases, the funds will be deducted from your available balance in Ringgit account. A 1% transaction fee will be charged by Visa / Mastercard and a 1% foreign exchange conversion mark-up will be imposed by the Bank.

Note: Some merchants might have automatically selected the Ringgit Malaysia currency for your transaction. If you do not wish to proceed with making the transaction in Ringgit Malaysia, you can ask the Merchant to cancel your transaction and select the foreign currency instead.

Q35. If I perform a Telegraphic Transfer to Japan with Japanese Yen (JPY), can I send using the available Japanese Yen in my account?

A35. Yes, you can as long as you have enough Japanese Yen balance in your account.

Q36. If I perform an online purchase that charges me in USD, can I pay for it using the USD available in my account?

A36. Yes, you can. When you pay with your debit card, it will automatically debit from your USD balance in the account.

Q37. Can my friend who has USD in his Pay&Save/ Pay&Save-i or HLB Wallet account, transfer USD to me?

A37. No, he won’t be able to. All incoming fund transfers can only be in MYR.

Q38. Can I view all my overseas transactions on HLB Connect Online and HLB Connect App?

A38. Yes, you can view your overseas transactions on HLB Connect Online and HLB Connect App. Here's how:

- HLB Connect App: Tap on your ‘Pay&Save’ or 'HLB Wallet' account box > Tap on the flag image of the foreign currency

- HLB Connect Online: Click on ‘+ Show All Currencies’ under your ‘Pay&Save’ account at the account overview page > click on the currency link next to the flag’s image

Q39. I’m overseas and My debit card transaction / ATM Withdrawal is not working, what’s wrong and what should I do?

A39. This could be due to your Debit Card settings. Please check if the Overseas Withdrawal & Overseas Retail Purchases are enabled. Here’s how

On HLB Connect App: Tap on MENU > tap on ‘Account Settings & Limit’ > ‘Debit Card Settings & Limit’ > toggle on the ‘Overseas Retail Purchase’ to enable overseas debit card usage.

QR PAY

Only available on HLB Connect App

Q40. What is QR PAY?

A40. QR Pay is a cashless payment feature on HLB Connect App. It lets you pay merchants or friends/family by scanning a QR Code. In Malaysia, it accepts DuitNow QR (Malaysia’s National QR Standard established by PayNet under the BNM’s Interoperable Credit Transfer Framework).

You can also use QR Pay to make instant payments to merchants in other countries, including Indonesia (QRIS QR Code), Singapore (NETS QR Code), Thailand (PromptPay QR Code) and Cambodia (Bakong QR Code).

Q41. How do I make a payment with QR PAY?

A41. On HLB Connect App’s login screen, tap the ‘QR Pay’ icon. Then, scan the DuitNow QR Code from the merchant or recipient you’re paying, OR the QRIS/PromptPay/NETS/Bakong QR Code for foreign merchants. Enter the amount you want to pay. You can also find ‘QR Pay’ after you’ve logged in by tapping on ‘Menu’.

If the recipient has already set the amount in their QR Code (called a Dynamic QR Code), that exact amount will be deducted from your account when you scan it.

Q42. How do I receive payment with QR PAY?

A42. On HLB Connect App’s login screen, tap ‘Receive QR Payment’ to generate a DuitNow QR Code for the payer to scan and make a payment. If you wish to specify the amount to receive, tap ‘Generate QR with Amount’ before sharing the QR Code. You can also find ‘Receive QR Payment’ after logging in by tapping on ‘Menu’.

Q43. What do I need to have in order to use QR PAY?

A43. To use QR Pay for sending or receiving funds, you need to be a HLB Connect user and have the HLB Connect App downloaded on your mobile phone.

- To make a QR payment: You need sufficient funds in your HLB Current or Savings Account, OR an available credit limit on your HLB Credit Card (only for merchant DuitNow QR Code). Do note that some merchants might not accept credit card payments via QR Code.

- To receive QR payments: You’ll need a HLB Current or Savings Account.

Q44. Can I make or receive QR payments from customers of other banks?

A44. Yes, you can. Just follow the same steps in Q45 (for paying) and Q46 (for receiving) to transact with customers from other banks.

Q45. How long does it take for QR payments/receiving fund to go through?

A45. The fund will go through instantly once the transaction is successful.

Q46. If I have multiple accounts, how do I choose which account to make or receive QR payments?

A46. You can set a default account to make or receive QR payments:

a) For QR Pay:

- The first time you use QR Pay, you’ll be prompted to choose which of your HLB Current or Savings Account/HLB Credit Card you want to pay from. This selection will become your default account for future QR payments.

- To change your default account, in HLB Connect App, tap ‘Menu’ > ‘App Settings’ > ‘Manage QR Settings’.

b) For Receive QR Payment:

- Before you share your DuitNow QR Code for your payer to scan, tap ‘Change Bank Account’ to choose a different HLB Current or Savings Account to receive the funds.

Q47. How come sometimes I don’t have to enter the amount when scanning a QR?

A47. This happens when you scan a Dynamic QR Code. The recipient has already pre-set the amount in the QR Code. So when you scan it, you’ll see the exact amount displayed, and that’s the amount that will be debited from your account.

Q48. Do I need to use AppAuthorise for QR Pay transactions?

A48. Biometric (Fingerprint/Face ID) or Password, along with AppAuthorise is required if your total daily cumulative amount have exceeded the Bank’s default limit or the specific limit that you’ve set for ‘QR Pay without authentication’. This accumulated amount resets daily.

To adjust your limit, tap ‘Menu’ > ‘Account Settings & Limits’ > ‘Transaction Limits’ > ‘Transfer’ > ‘QR Pay without Authentication’.

Q49. What is the maximum amount that I can pay/receive via QR Pay?

A49. The maximum you can pay via QR Pay is RM10,000 per day. However, this is also subjected by any QR Pay limits you’ve set for yourself. To adjust your limit, tap ‘Menu’ > ‘Account Settings & Limits’ > ‘Transaction Limits’ > ‘Transfer’ > ‘QR Pay’.

Q50. Which debiting/payment account can I choose for QR Pay?

A50: You can choose to pay using your HLB Current/Savings account or HLB Credit Card.

However, do note that some QR merchants do not accept credit card payments and you will need to change the payment account to a Current/Savings account.

Q51. Can I use QR PAY to make payment to someone who does not have / use DuitNow QR service?

A51. You will not be able to use QR Pay to make payment to someone who does not use a National QR Code (DuitNow QR Code) service. You may use instant transfer / DuitNow service instead.

Q52. Is there any additional charges / fee for using QR PAY?

A52. No, there is no charges / fee for using QR PAY.

Q53. Can I use QR PAY on HLB Connect Online?

A53. To generate a DuitNow QR Code on HLB Connect Online, after logging in, go to your Current/Savings Account tab. Under ‘Actions’, click ‘View Details’ dropdown, then select ‘Receive Payment’, and download the QR Code as a PDF.

Q54. Can I use the same DuitNow QR Code to request for payments from multiple friends or parties?

A54. Yes, you can share the same DuitNow QR Code to receive/request for payments from multiple payers. If you’ve set a specific amount for that QR Code (called a Dynamic QR Code), everyone who scans it will pay you that same amount. Important: A Dynamic QR Code is only valid for 1 minute after it’s generated.

Q55. Can I use QR Pay if my mobile phone doesn’t have a camera function?

A55. No, you can’t. QR Pay needs your phone’s camera to scan the DuitNow QR Code for making payments.

Features for Sole Proprietors or Small Business Owners

Q56: I’m a business owner. Can I use HLB Connect for my business account?

A56: Yes, you can. But you will have to register for HLB Connect using your Business Registration Number that is tied to your HLB CASA account.

Q57. What is an ‘Admin Clerk’ feature on HLB Connect?

A57. ‘Admin Clerk’ a feature available in HLB Connect Online for Sole Proprietors/small Business Owners that are on Connect.

Q58. What do you need to access the ‘Admin Clerk’ feature?

A58. Customers with business account and who have registered for HLB Connect using their NRIC will be able to access this feature.

Q59. How do you add / enable an ‘Admin Clerk’?

A59. Here’s how:

- Step 1: Click on the Business Account you wish to designate an Admin Clerk

- Step 2: On ‘Business Account’ page, click ‘Add’ to create an HLB Connect login credentials for your Admin Clerk

- Step 3: Setup the following for your Admin Clerk: (i) Admin Clerk details (i.e. Name, Mobile Number, Email Address & Date of Birth) (ii) Admin Clerk HLB Connect login credentials (i.e. Username, Password & Security Picture) (iii) Setup the required daily limit and function access

- Step 4: Review details and enter six-digit TAC sent to your registered mobile number

Q60. Does my Admin Clerk have to be a HLB Customer and/or an existing Connect users?

A60. No, your Admin Clerk does not have to be an existing HLB Customer or Connect users. You should assign the Admin Clerk role from the pool of your trusted employees.

Q61. What can the Admin Clerk do?

A61. The Admin Clerk can only initiate payments / fund transfer from your business account where you have enabled the feature. The transactions will still need your approval (via AppAuthorise) before it can proceed.

Q62. How does my Admin Clerk get started?

A62. Your Admin Clerk will need to use the login credentials created by you and log in at www.hongleongconnect.com.

Q63. Can I disable / change the person assigned as my Admin Clerk.

A63. Yes, you can. Simply click on your business account and click on ‘Manage’ under the previous Admin Clerk’s name and select ‘Change Admin Clerk’. Follow the instructions on the screen to set up the new Admin Clerk’s credentials.

Q64. What are services available in HLB Connect for Mortgage/Property Financing-i customers?

A64. The following are services available for Mortgage/Property Financing-i customers of Hong Leong Bank:

i. Request for a copy of Mortgage/Property Financing-i security documents.

ii. Request to start early instalment for Mortgage/Property Financing-i interest/profit servicing account. This can help reduce your interest/profit payment.

iii. Request to increase the amount for mortgage monthly instalment. This can help reduce your Mortgage/Property Financing-i interest/profit payment and tenure.

Q65. How do I Request a copy of my Mortgage/Property Financing-i security documents in HLB Connect?

A65. Here’s how: log in to HLB Connect Online > click on your Mortgage/Property Financing-i account link to get to your account overview page > click on ‘Services’ > click on ‘Request’ button below ‘Loan/Financing Documents’

Q66. How do I request to start early instalment for my Mortgage/Property Financing-i interest/profit servicing account?

A66. Here’s how: log in to HLB Connect Online > click on your Mortgage/Property Financing-i account link to get to your account overview page > click on ‘Services’ > click on ‘Request’ button under ‘Monthly Instalment Payment’

Q67. How do I request to increase the amount for my mortgage monthly instalment?

A71. Here’s how: log in to HLB Connect Online > click on your Mortgage/Property Financing-i account link to get to your account overview page > click on ‘Services’ > click on ‘Request’ button under ‘Increase Instalment Amount’

G. PRODUCT APPLICATION / SUBSCRIPTION

You can apply / subscribe for the following e-Products on HLB Connect.

Note: e-Products application cannot be performed between 12-6am.

Online Fixed Deposit (e-FD) / Online Islamic Fixed Deposit (eFD-i)

Q1. What is an eFD/eFD-i?

A1. eFD is a certless Fixed Deposit that can be placed and withdrawn via HLB Connect. eFD-i is a certless Fixed Deposit-i that can be placed and withdrawn via HLB Connect. It is an Islamic product which is based on Commodity Murabahah via Tawarruq concept.

Q2. How do I place a new eFD/eFD-i via FPX or DuitNow Online Banking Wallets?

A2. To place a new eFD/eFD-i via FPX or DuitNow Online Banking/Wallets (DuitNow OBW), you have to log in to your HLB Connect and follow the steps below.

- HLB Connect Online: APPLY > Create Account / New Placement (under Fixed Deposit)

- HLB Connect App: MENU > Fixed Deposit and select New Placement

Q3. How do I withdraw my eFD /eFD-i?

A3. To withdraw your eFD/eFD-i, simply log in to your HLB Connect and follow the steps below.

- HLB Connect Online: APPLY > Withdrawal (under Fixed Deposit)

- HLB Connect App: MENU > Fixed Deposit and select Withdrawal

Q4. Who is eligible to open an eFD/eFD-i account?

A4. eFD/eFD-i is open to all individuals aged 18 years and above having a Current or Savings Account with the Bank. eFD/eFD-i is also available to joint account holders.

Q5. What is the minimum placement for an eFD/eFD-i?

A5. Minimum placement will be as follows:

a) For 1 month – RM5,000

b) For 2 months and above – RM500

Q6. How will the interest of eFD / profit of eFD-i be paid?

A6. It will be paid into the linked current or savings account on a monthly basis or upon maturity.

Q7. Any penalty for premature withdrawal?

A7. No interest / profit will be paid for premature withdrawals of eFD/eFD-i regardless of the number of completed months at the time of withdrawal.

Q8. Can I make partial withdrawal?

A8. Partial withdrawal is available for eFD/eFD-i. The minimum withdrawal amount is RM1,000 and can only be made in multiples of RM1,000. Also, a minimum of RM5,000 must be maintained in the eFD/eFD-i account. No interest / profit will be paid for premature withdrawals of eFD/eFD-i regardless of the number of completed months at the time of withdrawal.

Q9. Can I open a joint eFD/eFD-i account?

A9. Yes, you can. Joint eFD/eFD-i account is available in HLB Connect.

Q10. Can I withdraw my eFD/eFD-i over the counter?

A10. eFD/eFD-i withdrawal can only be done via HLB Connect.

Q11. Will I receive any receipt upon placement/renewal?

A11. You will only be able to view and print the digital receipt via HLB Connect.

Q12. Will I receive a monthly statement?

A12. You will not receive a monthly statement but you will be able to view your eFD/eFD-i statement on HLB Connect.

Q13. Is eFD/eFD-i eligible for protection by PIDM?

A13. Yes, eFD/eFD-i is eligible for protection by PIDM.

Q14. Can I pledge my eFD/eFD-i as collateral?

A14. No, eFD/eFD-i cannot be pledged as collateral.

Balance Transfer

Q29: What is Balance Transfer?