How To Get Better Currency Exchange Rates For Your Next Trip

Travelling abroad can be an exciting adventure, but it’s essential to keep a close eye on your budget. One way to maximise your travel funds is by securing the best possible currency exchange rates. Even a slight difference in exchange rates can have a significant impact on your spending power, especially over an extended trip. By understanding how exchange rates work and taking steps to find the best rates, you can make the most of your money and enjoy a more cost-effective travel experience.

Understanding Foreign Currency Exchange Rates

Foreign currency exchange rates indicate the value of one currency relative to another. This rate fluctuates continuously due to factors such as global economic conditions, supply and demand, and market trends. There are two types of exchange rates:

1. Interbank Rates (Spot Rate)

This is the rate at which banks trade currencies with each other, and it represents the best possible rate for a currency exchange. However, consumers typically do not have access to this rate.

2. Conversion Rates by Banks and Money Exchange Services

The rates provided to customers often include a markup from the interbank rate. Banks, money changers, and other financial institutions charge a spread or a small fee to cover operational costs, making the rate slightly less favourable than the interbank rate.

Factors That Affect Exchange Rates for Travelers

1. Location of Exchange

Exchange rates vary based on the provider, with options like banks, airport kiosks, and local money changers each offering different rates. Generally, airport kiosks and hotels charge higher rates, making local money changers and banks a better choice.

2. Timing of Exchange

Exchange rates fluctuate, so timing your currency exchange wisely can help you get better rates. Monitoring exchange rates a few weeks before your trip and exchanging when the rate is favourable can save you money.

Tips to Get the Best Foreign Exchange Rates

1. Use Online Comparison Tools

Websites and mobile apps let you compare rates from different providers, including banks, online platforms, and local money changers. Using these tools can help you locate the best available rates without much effort.

2. Exchange Currency Before Your Trip

Avoid exchanging currency at airports, where rates tend to be higher. Instead, exchange your funds before you leave for your trip at a trusted money changer or your preferred exchange method.

3. Exchange Only What You Need

Exchange smaller amounts at first and keep an eye on rates during your trip. This approach lets you take advantage of favourable rates as they arise.

4. Consider Travel-Friendly Cards

Some banks offer travel credit or debit cards that apply competitive exchange rates with minimal fees. By using a travel-friendly card, you can enjoy the convenience of card payments abroad without worrying about high exchange costs.

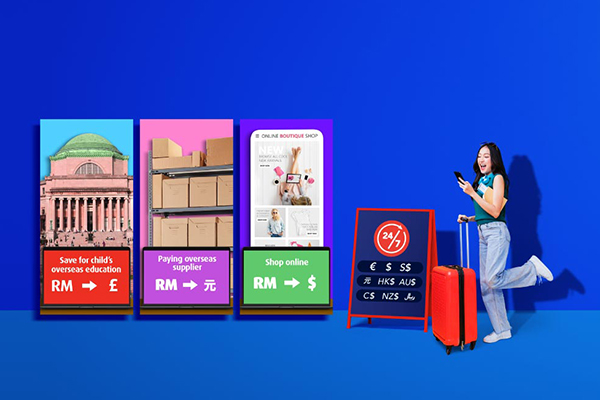

Using HLB Wallet and Pay&Save Account for Better Exchange Rates

The HLB Wallet offers an ideal, flexible way to carry and use foreign currencies when travelling. With HLB Wallet+, you can store, spend, and even withdraw funds in up to 12 major currencies at competitive exchange rates. Simply load up the currency you need before you travel, and avoid extra fees or fluctuating rates during your trip. HLB Wallet+ is perfect for those who prefer a simple, mobile-friendly solution to manage travel funds and spend conveniently overseas.

For travellers who need a comprehensive savings account with additional multi-currency flexibility, HLB Pay&Save is an excellent option. With HLB Pay&Save Account, there’s no need to open separate multi-currency accounts for each currency. You can access multiple foreign currencies from a single account, making it easy to manage your money before, during, and after your trip. Both HLB Wallet and Pay&Save account are seamlessly integrated with the HLB Connect mobile banking app.

Conclusion

Securing favourable exchange rates is an essential part of travel planning, helping you stretch your travel funds and enjoy your journey with fewer financial worries. By comparing rates and exchanging currency strategically, you can save money and simplify foreign currency management.