The Rise of QR Code Payments in Malaysia

The digital economy has been rapidly transforming, with more businesses and consumers shifting towards cashless transactions. One of the standout technologies in this evolution is paying with QR in Malaysia. As Malaysia embraces the convenience and speed of digital payments, QR codes are playing a central role in driving this transition. With the rise of QR code payments and their benefits, this article explores how Hong Leong Bank is offering our own solution through HLB Connect QR Pay.

Overview of QR Code Technology in Digital Payments

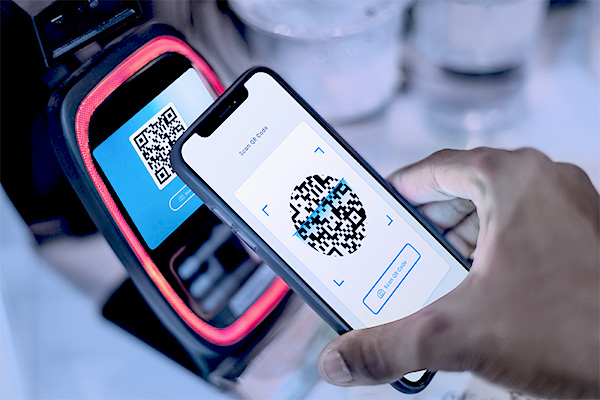

QR (Quick Response) codes have evolved into a versatile tool for digital payments. With a simple scan using a smartphone, users can make payments seamlessly without needing cash or cards. This method is used nationwide as it offers a fast, secure, and contactless way to transact conveniently.

Growth of Cashless Transactions in Malaysia

The shift towards a cashless society in Malaysia has gained remarkable momentum in recent years. According to a Visa Consumer Payment Attitudes (CPA) study, more than two-thirds of Malaysian consumers have attempted to embrace a cashless lifestyle. This growth is further fueled by the rising number of merchants accepting digital payments, particularly in dining, retail shopping, and supermarkets.

This increasing acceptance and adoption of digital payments are driving Malaysia’s journey towards becoming a fully cashless society. QR payments have played a significant role in this shift, offering consumers and businesses a fast, secure, and convenient way to transact without the need for physical cash.

By following these steps, you’ll be better prepared to make informed investment decisions that align with your financial goals and risk tolerance.

How QR Code Payments Work

The QR payment process is straightforward. When a consumer is ready to make a purchase, they simply scan the merchant's QR code using their bank’s app or a digital wallet, input the amount, and confirm the payment. The transaction is processed instantly, and both parties receive a notification of the payment.

Benefits of QR Code Payments

1. Convenience

QR code payments offer unparalleled convenience for both consumers and businesses. Payments can be completed in seconds, making it ideal for situations where speed is essential, such as in retail or dining.

2. Security

With QR payments, consumers don't need to carry large amounts of cash, reducing the risk of theft. In addition, since no physical cards are exchanged, the chances of card fraud are minimised. Transactions are protected by bank-grade encryption and other security measures.

3. Affordability

For small businesses, QR code payments are an affordable option compared to traditional point-of-sale (POS) systems. The transaction fees associated with QR payments are typically lower, which can be a major advantage for small and medium enterprises (SMEs) looking to keep operating costs down.

Using HLB Connect QR Pay Feature

Hong Leong Bank has integrated a powerful QR payment feature into its HLB Connect app, making it easier than ever for customers to make and receive payments.

1. How to Use the QR Pay Feature to Make Payments

To make a payment, users simply need to open the HLB Connect app, select the 'QR Pay' option, and scan the merchant’s QR code. After entering the payment amount (if required), the user confirms the payment, and it’s processed instantly.

2. How to Receive Payments Using Their Own QR Code

Merchants and individuals can also use the HLB Connect app to generate their own QR codes for receiving payments. This feature is particularly useful for freelancers, small businesses, and vendors who may not have access to traditional POS systems.

The HLB Connect QR Pay feature offers several advantages, including real-time payment notifications, a clear transaction history for easy tracking, and secured transactions. This integration allows users to stay on top of their finances without the need for physical receipts or manual bookkeeping.

Adoption Of QR Payments in Malaysia Across Different Sectors

1. Retail

Many retailers, from large chains to small boutiques, are adopting QR code payments to enhance the customer experience. These also include supermarkets and department stores, enabling customers to make payments directly from their bank apps or e-wallets.

2. Restaurants and Street Vendors

QR payments are revolutionising how people pay for their meals. Restaurants and street vendors benefit from the speed and convenience, allowing them to serve more customers efficiently without dealing with cash.

3. E-Commerce and Online Businesses

QR payments have made a substantial impact on e-commerce, where businesses incorporate QR codes on their websites or at checkout to facilitate payments. This payment method has also extended to social media-based sales, where small businesses share QR codes through WhatsApp or Instagram to complete transactions with customers.

QR Payments for Cross-Border Transactions

One of the useful developments in QR payments is their increasing use for cross-border transactions within Southeast Asia. The HLB Connect QR Pay facilitates cross-border QR payments in Thailand, Indonesia & Singapore, making it easier for businesses and travellers to conduct transactions across borders.

Conclusion

The rise of QR code payments is transforming the financial landscape in Malaysia. With benefits like convenience, security, and affordability, QR payments are becoming the preferred choice for both businesses and consumers. As technology continues to advance, QR payments will likely become even more integral to the Malaysian economy.

Frequently Asked Questions

1. How do QR payments compare to other digital payment methods in Malaysia?

QR payments are faster, simpler, and more secure for both consumers and businesses compared to traditional digital payment methods like card transactions.

2. What are the costs associated with using QR code payments?

For small businesses, QR payments usually come with lower transaction fees than traditional POS systems, making them a cost-effective solution.

3. Can QR code payments be used internationally?

Yes, the HLB Connect QR Pay supports cross-border transactions in Thailand, Indonesia & Singapore.

4. Are there limits on transaction amounts for QR payments?

Transaction limits for QR payments depend on the bank or payment provider, but they typically offer flexible limits to accommodate both small and large transactions.

5. How can businesses integrate QR payments into their system?

Businesses can easily integrate QR payments by registering with a participating bank like Hong Leong Bank and setting up their own unique QR codes for receiving payments.