Features & Benefits

Hassle-free - No income documents required

Available via HLB Connect Online and HLB Branches

You must be the sole holder of the Fixed Deposit (FD) account, and it must be set to auto renew. Joint FD accounts are not acceptable for this application.

Only New-to-Card (NTC) applicant are eligible to apply.

More details

Less details

You must be the sole holder of the Fixed Deposit (FD) account, and it must be set to auto renew. Joint FD accounts are not acceptable for this application.

Only New-to-Card (NTC) applicant are eligible to apply.

More details

Less details

High approval rate

No maximum in age limit

Assigned credit limit will be based on the pledged FD amount at a ratio of 1:1

The eligible card type and corresponding minimum FD pledge amount are as follows:

Card Type |

Min FD Pledge Amount (RM) |

|---|---|

WISE |

2,000 |

Essential |

2,000 |

GSC Gold |

2,000 |

I’M |

2,000 |

Sutera Platinum |

3,000 |

GSC Platinum |

12,000 |

Infinite |

30,000 |

Not applicable to the following Fixed Deposit Plans:

a) Flexi Fixed Deposit

b) Junior Fixed Deposit

c) Fixed Deposits placed for Malaysia My Second Home Programme (MM2H)

d) Any Islamic Fixed Deposit

e) Any Minor/Trust Fixed Deposit Account

f) Fixed Deposits from another banking institution

g) Fixed Deposit/e-FD pledged as collateral for a banking facility

Simple steps to apply for a Secured Credit Card via HLB Connect Online

Log in to your HLB Connect Online

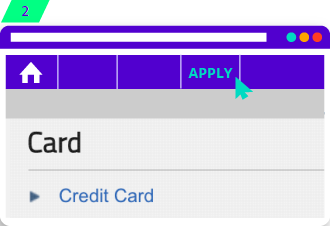

On the tab above, click "Apply"

Under "Card", select "Credit Card"

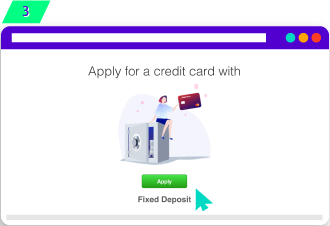

Select “Apply for a credit card with Fixed Deposit"

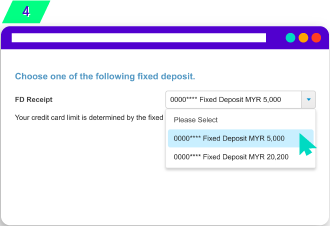

Select the Fixed Deposit that you want to pledge

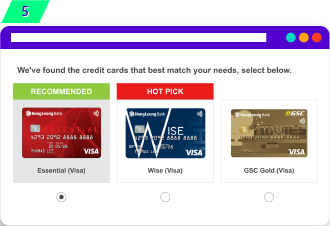

Select your preferred Credit Card and fill up your personal details

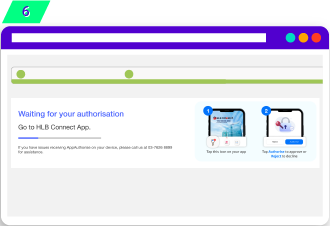

Authorize your application through HLB Connect App to confirm your application

Simple steps to apply for a Secured Credit Card via HLB Branch

Step 1: Walk-in to the nearest HLB Branch

Step 2: Consult any of our Branch staff

Step 3: Our HLB Branch staff will assist with your Secured Credit Card application