Deposit | 01 March 2025-31 December 2025

Diversify your savings with foreign currencies

earn daily interest/profit*

Why Save in Foreign Currencies?

- 1Future travels

- 2Children's education

- 3Higher daily interest/profit rate

- 4Potential capital gain from foreign currency appreciation

- 5Savings diversification options

- 6Competitive foreign exchange rates

- 7Easy access to your funds for international travel and spending

How to save in foreign currency

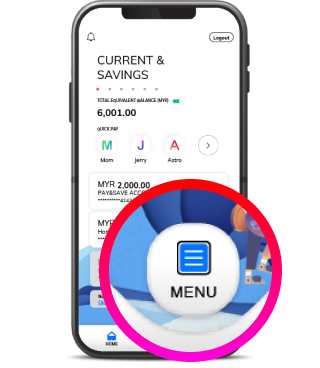

STEP 1

Log into HLB Connect App

and tap Menu

STEP 2

Select

Foreign Currency Deposit

STEP 3

Select currency &

enter amount

STEP 1

Login and click on Buy Foreign Currency

button next to your Pay&Save Account/-i

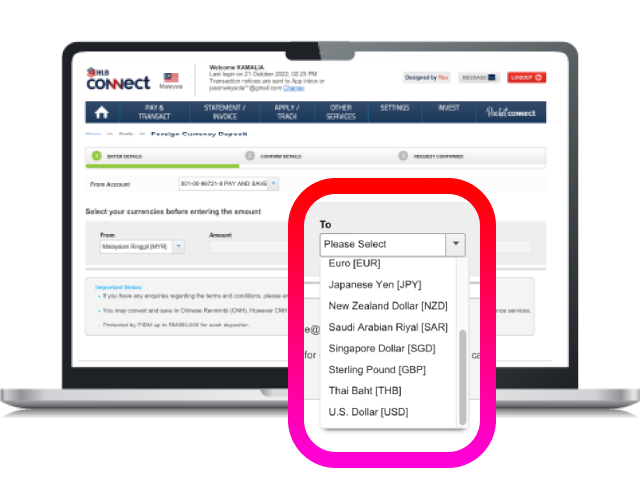

STEP 2

Kindly select the currency you would like to convert and enter the amount

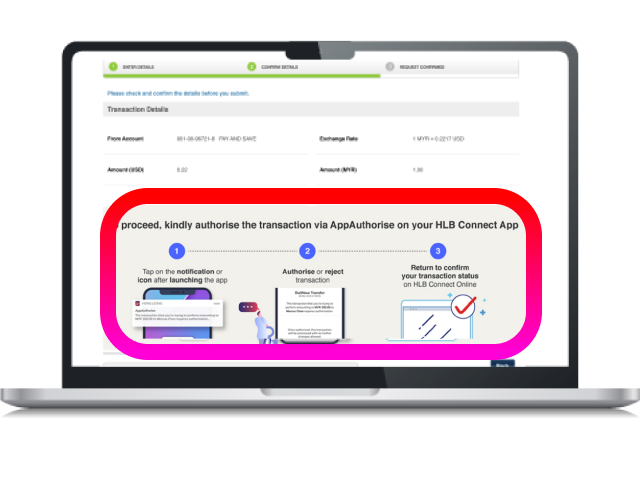

STEP 3

Follow instructions on screen to proceed

Visit our nearest branch

Visit our nearest branch

Multi-Currency Supported Accounts

DISCLAIMER:

The information shown is indicative and for illustration only. The Bank does not guarantee the accuracy of the calculation and accepts no liability for any inaccuracies or omissions. Foreign currency deposits are subject to foreign exchange risks or fluctuation and the rates may go up or down. Past performance of a foreign currency is not an indicator of its future performance. The gain on foreign currency deposit is not guaranteed and is subject to foreign exchange and investment risks.

KINDLY BE REMINDED:

The operations, sources and uses of funds to and from the MCF Enabled Account shall be governed in accordance with the Investment Foreign Currency Account (“IFCA”) under the Foreign Exchange Policy Notices ("FEP Notices") issued by Bank Negara Malaysia (“BNM”).

*Terms and Conditions apply.

Member of PIDM. Protected by PIDM up to RM250,000 for each depositor.