Personal Loan/Financing-i | 01 April 2024-30 June 2024

*Interest/profit rate of 3.60% p.a. is applicable for self-employed customers with a verified monthly income of RM8,000 and above, who are eligible for 60% Pay-On-Time Rebate on a flat interest/profit rate of 9.00% p.a.

Interest/Profit Rate

Our rate is on a flat rate basis

Salaried Segment

Verified Monthly Income |

Flat Interest/Profit Rate |

Applicable Pay-On-Time Rebate |

Rate after Pay-On-Time Rebate |

|---|---|---|---|

RM2,000 – RM7,999 |

9.50% p.a. |

20% |

7.60% p.a. |

RM8,000 and above |

60% |

3.80% p.a. |

Self-employed Segment

Verified Monthly Income |

Flat Interest/ Profit Rate |

Applicable Pay-On-Time Rebate |

Rate after Pay-On-Time Rebate |

|---|---|---|---|

RM2,000 – RM7,999 |

9.00% p.a. |

20% |

7.20% p.a. |

RM8,000 and above |

60% |

3.60% p.a. |

(i) Effective interest/profit rate applicable to flat rate of 9.00% p.a. vary from 15.71% p.a. to 16.43% p.a. depending on loan/financing tenures from 2 to 5 years.

(ii) Effective interest/profit rate applicable to flat rate of 9.50% p.a. vary from 16.50% p.a. to 17.29% p.a. depending on loan/financing tenures from 2 to 5 years.

(iii) 0.50% of the Facility Amount will be deducted upon disbursement for stamp duty payable.

Enjoy up to 60% interest/profit rebate when you pay on time!

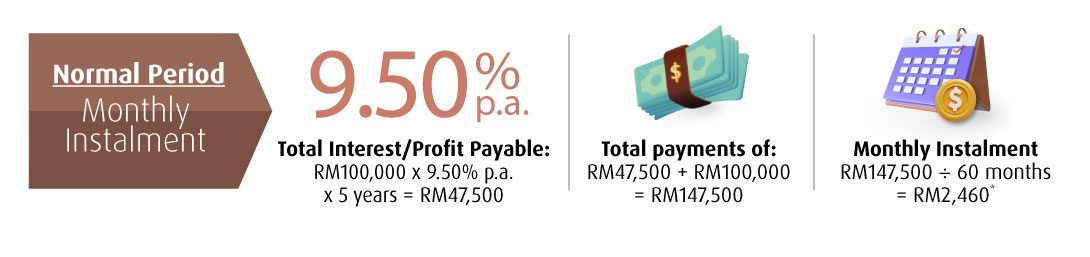

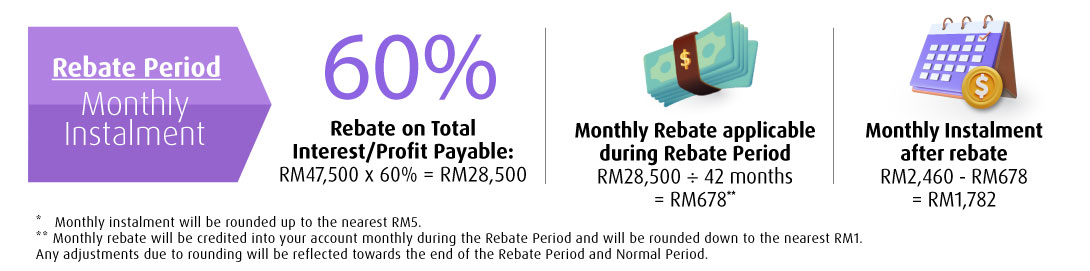

For example, you are a salaried customer with verified monthly income of RM8,000 and above. The applicable interest/profit rate is 9.50% p.a. and your total approved facility amount is RM100,000 for a financing tenure of 5 years. You also qualify for 60% Pay-On-Time Rebate. The above example is illustrated below:

- Malaysian citizens aged between 21 to 60 years old

- Employed or self-employed with minimum annual income of RM24,000

- Minimum loan/financing-i amount is RM5,000

- Maximum loan amount is RM250,000 for Personal Loan and maximum financing amount is RM150,000 for Personal Financing-i

Click I’m Interested and leave your contact details. We will contact you within 48 business hours.