Personal Loan/Financing-i | 01 April 2024-30 June 2024

*Applicable for self-employed applicants with a verified monthly income of RM8,000 and above and apply via the Bank’s Website.

Our rate is on a flat rate basis

Application Channel: Online (Bank’s Website) |

||

|---|---|---|

Verified Monthly Income |

Flat Interest/Profit Rate |

Facility Tenure |

RM2,000 – RM7,999 |

7.50% p.a. |

2 to 5 years |

RM8,000 and above |

5.25% p.a. |

|

Note: The effective interest/profit rates vary as follows for loan/financing-i tenure from 2 to 5 years:

(i) Flat interest/profit rate 5.25% p.a.: Effective interest/profit rates vary from 9.58% p.a. to 9.78% p.a.

(ii) Flat interest/profit rate 7.50% p.a.: Effective interest/profit rates vary from 13.32% p.a. to 13.80% p.a.

(iii) 0.50% of the facility amount will be deducted upon disbursement for stamp duty payable.

Illustration of Instalments

For example, you are an applicant with a verified monthly income of RM8,000 and above and you apply via the Bank’s Website. The applicable interest/profit rate is 5.25% p.a. and your total approved facility amount is RM100,000 for a financing tenure of 5 years. The above example is illustrated below:

*Monthly instalment amount will be rounded up to the nearest RM5.

Any adjustment due to rounding will be reflected towards the end of the facility tenure.

- Malaysian citizens aged between 21 to 60 years old

- Self-employed customers with a minimum annual income of RM24,000

- Minimum loan/financing amount is RM5,000

- Maximum loan amount is RM250,000 for Personal Loan and maximum financing amount for Personal Financing-i is RM150,000

- Exclusively for online applications only

Note: If you are a salaried customer, please click here to view our promo for salaried customers.

Note: If you are an existing HLB Connect user, you may also login and apply via HLB Connect Online.

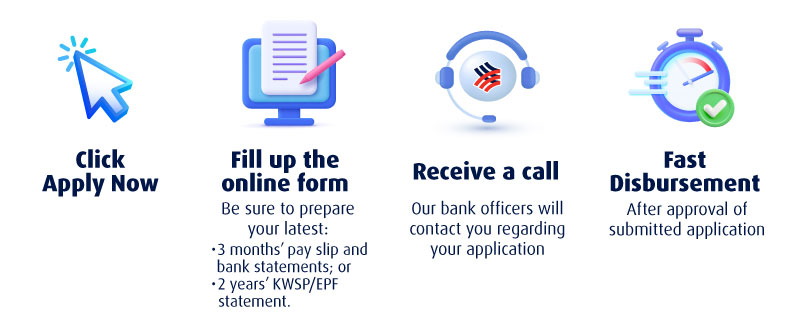

You will be prompted to upload the following 5 documents for your online application. Prepare these documents before you start your online application.

Accepted formats: .jpeg, .jpg, .pdf or .png

Max file size: 5MB per document

For Self-Employed Applicants

1. NRIC front

2. NRIC back

3. Business Registration Document

4. Latest 1 year Form B with tax receipt OR latest 6 months company bank statements OR latest 2 years EPF statement (Sdn Bhd only)

5. Optional documents (e.g., latest 6 months’ salary slips/6 months commission slips with crediting proof, rental income, etc.)