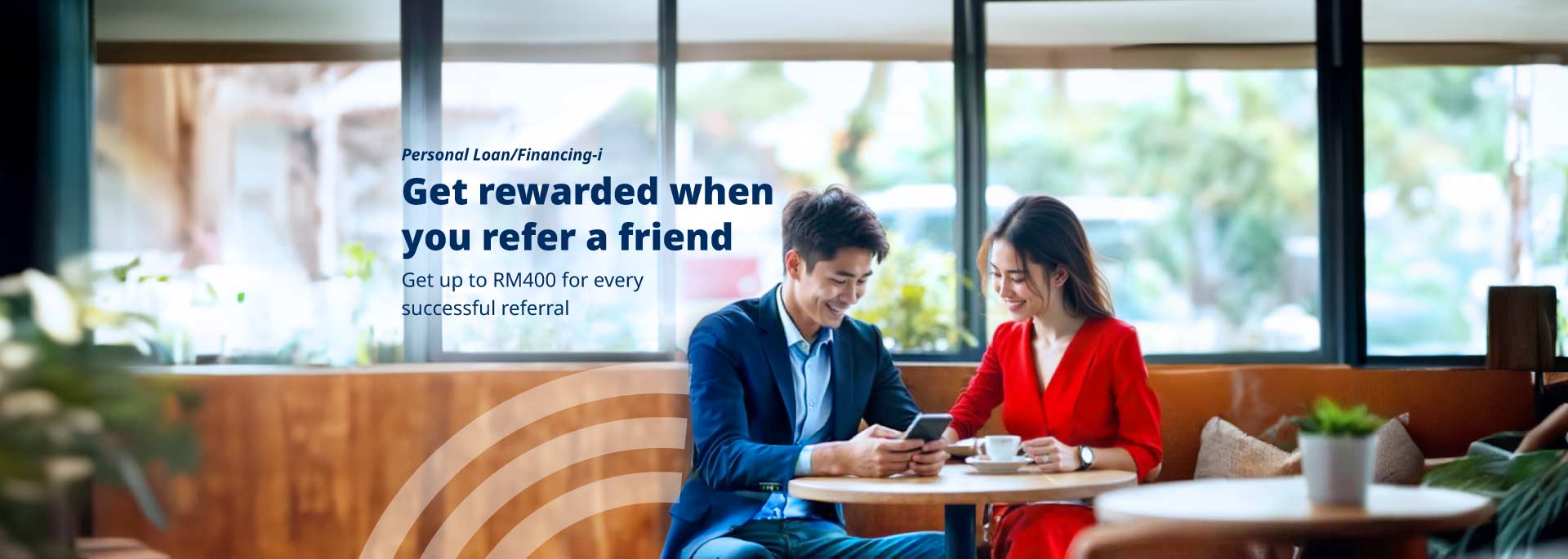

Personal Loan/Financing-i | 07 April 2025-30 June 2025

Turn your recommendations into rewards.

Invite your friends to apply for a HLB Personal Loan/HLISB Personal Financing-i online and get up to RM400 for every successful referral. There is no limit to the number of friends you can refer. This means, if you successfully refer 20 friends, you could get up to RM8,000.

Hurry, refer your friends now. Offer valid until 30 June 2025.

Terms and conditions apply. This promotion is eligible for customers with a valid and active principal Credit Card and/or individual/joint current account/current account-i and/or savings account/savings account-i (“CASA/CASA-i”) with HLB and/or Hong Leong Islamic Bank Berhad (“HLISB”) who refer their friends to apply HLB Personal Loan / HLISB Personal Financing-i.

You can copy your unique Referral Code in just a few taps via HLB Connect Online or HLB Connect App,

and share it through WhatsApp.

Referring friends has never been simpler. Here’s how it works:

Referrer (I want to invite my friends)

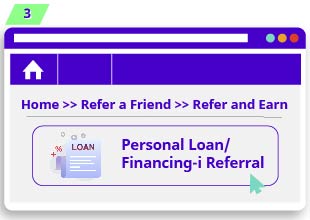

On HLB Connect Online:

Log in to your HLB Connect Online

and click “Other Services”

Under “Refer a Friend”,

select “Refer and Earn”

Select “Personal Loan/Financing-i Referral”

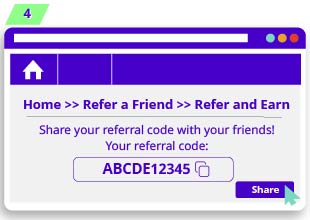

Share your Referral Code with

your friends

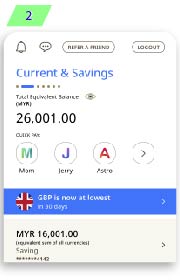

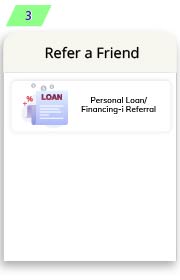

Share Referral Code on HLB Connect App:

Log in to your

HLB Connect App

Click “Refer a Friend” at the top of the page

Select “Personal Loan/Financing-i Referral”

Share your Referral Code

with your friends

Preview the referral

message to your friends

Send the referral message

to your friends via WhatsApp

Apply Personal Loan/Financing-i on HLB/HLISB Website:

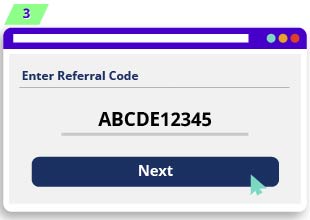

Enter the Referral Code and click “Next”

Follow the steps to complete the

Personal Loan/Financing-i Application

Apply for a Personal Loan/Financing-i on HLB Connect Online

(for existing HLB customers):

Log in to your HLB Connect Online

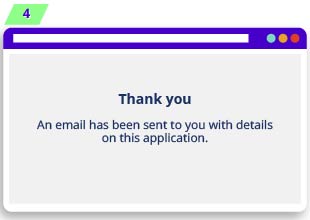

From the “Apply” menu, under

“Loan/Financing”, select “Personal Loan/Financing-i”

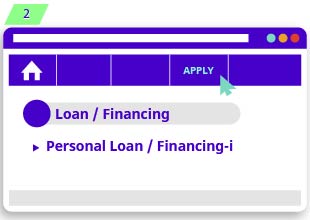

Enter the Referral Code

Follow the steps to complete the

Personal Loan/Financing-i Application

FAQ

1. What is the HLB Personal Loan/HLISB Personal Financing-i Referral Program?

It is an online referral program for existing HLB/HLISB customers (“Referrer”) to refer their friends and family (“Referee”) who do not have an HLB Personal Loan/HLISB Personal Financing-i to apply for a new HLB Personal Loan/HLISB Personal Financing-i.

The Referrer can share their unique Referral Code via WhatsApp. The Referrer will be tagged to the Referee(s) and rewarded only if the Referee(s) submits the Personal Loan/Financing-i application online using the Referrer’s Referral Code, and the application is successfully approved by HLB/HLISB according to the terms of this promotion.

2. Who is eligible to participate in the HLB Personal Loan/HLISB Personal Financing-i Referral Program?

All existing-to-bank customers who have HLB Connect and a valid and active principal Credit Card and/or individual/joint current account/current account-i and/or savings account/savings account-i (“CASA/CASA-i”) with HLB and/or Hong Leong Islamic Bank Berhad (“HLISB”) (collectively referred to as “the Bank”) .

3. Are HLB supplementary credit cardholders eligible to participate in the HLB Personal Loan/HLISB Personal Financing-i Referral Program?

Supplementary HLB Credit Cardholders (without an individual/joint CASA/CASA-i account with the Bank or principal HLB Credit Card) are not eligible to participate in the Promotion.

4. Are joint CASA/CASA-i holders with the Bank eligible to participate in the HLB Personal Loan/HLISB Personal Financing-i Referral Program?

Yes, joint CASA/CASA-i holders with the Bank are eligible to participate in the Promotion.

5. What is a Referral Code?

A Referral Code is a 10-character unique combination of alphabets and/or numbers which is used to track the origin of a referral to match the referrers to the referees. The Referrer can share their Referral Code via WhatsApp.

6. How and when the reward will be credited to the Referrer?

The bank will notify qualified Referrers by posting a list of eligible customers (including masked names, masked NRICs, and reward entitlements) on the promotion page.

The cash reward will be credited to the qualified Referrer’s CASA/CASA-i or credit card account within 120 days from the last day of each promotion month.

This applies only if the application is successfully disbursed within the disbursement period.

For specific fulfillment dates, please refer to the Terms and Conditions.

7. How does the Cash Reward work?

The Cash Reward is based on the disbursed financing amount for each Referee introduced by the Referrer. The Cash Reward cannot be combined or accumulated across Referees. Here’s an example:

Calculation:

Referrer A introduces two referees, and the Cash Rewards are accorded individually based on each respective Referee’s disbursed financing amounts:

i. Referee 1:

a. New Personal Loan/Financing-i Disbursed Financing Amount: RM30,000

b. Cash Reward: RM200

ii. Referee 2:

a. New Personal Loan/Financing-i Disbursed Financing Amount: RM100,000

b. Cash Reward: RM400

Total Cash Reward for Referrer A:

RM200 (Referee 1) + RM400 (Referee 2) = RM600

8. What happens if the wrong Referral Code is entered?

To ensure accurate tracking and reward eligibility, please double-check that the Referrer’s code is entered exactly as provided. If an incorrect or invalid Referral Code is used, the Referrer will not be eligible for any rewards.