Personal Loan/Financing-i | 13 December 2024-31 March 2025

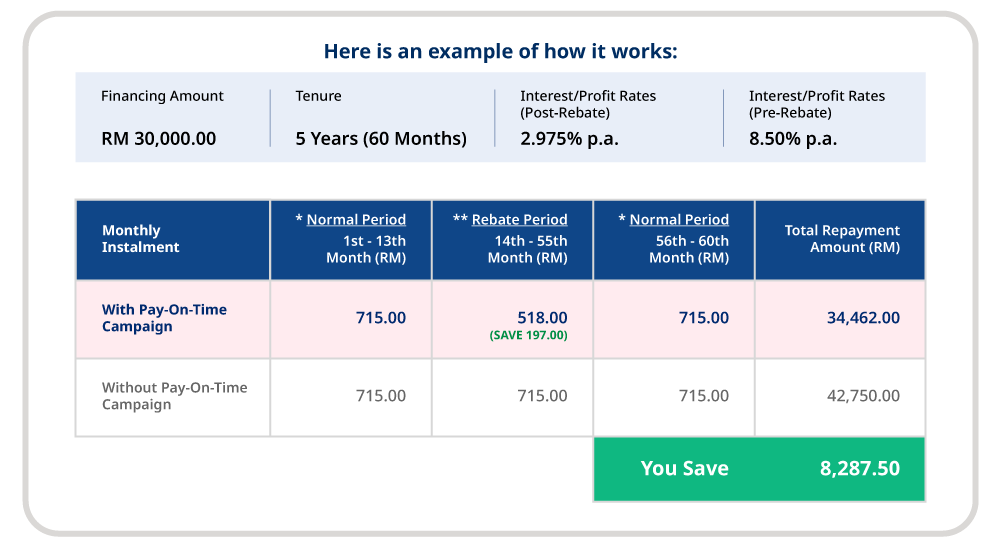

This table shows examples of monthly instalment amounts for different

Personal Loan/Financing-i amounts over a 5-year tenure, including total savings:

*Monthly instalments will be rounded up to the nearest RM5.

** Monthly rebates will be credited into your account monthly during the Rebate Period and will be rounded down to the nearest RM1.

Any discrepancies in the toal settlement amount and in the total savings due to rounding of monthly instalments and monthly rebates will be adjusted in the final month of the Rebate Period and on the final month of the Normal Period.

Our rate is on a flat rate basis

Verified Monthly Income |

Disbursement to CASA/CASA-i |

||

|---|---|---|---|

Flat Interest/Profit Rate |

Applicable Pay-On-Time Rebate | Rate after Pay-On-Time Rebate. | |

| RM8,000 and above | 8.50% p.a. |

65% | 2.975% p.a |

(i) Effective interest/profit rate applicable to flat rate of 8.50% p.a. vary from 14.92% p.a. to 15.55% p.a. depending on loan/financing tenures from 2 to 5 years.

(ii) 0.50% of the Facility Amount will be deducted upon disbursement for stamp duty payable.

(iii) To enjoy the Pay-On-Time Rebate, please ensure to:

a. The financing is disbursed to your HLB/HLISB Current Account/Currenct Account-i and/or Savings Account/Savings Account-i ("HLB CASA/HLISB CASA-i)

b. You pay your monthly instalment promptly by the due date every month

c. You maintain a cumulative daily balance of RM500 in your HLB CASA/HLISB CASA-i for the first thirteen (13) months from your instalment due date.

- Malaysian citizens aged between 21 to 60 years old

- Employed with minimum annual income of RM96,000

- Minimum loan/financing amount is RM5,000

- Maximum loan amount is RM250,000 for Personal Loan and maximum financing amount for Personal Financing-i is RM150,000.

- Facility tenures from 2 to 5 years

You will be prompted to upload the following 5 documents for your online application. Prepare these documents before you start your online application.

Accepted formats: .jpeg, .jpg, .pdf or .png

Max file size: 5MB per document

For Salaried Applicants (Fixed or Variable Income)

NRIC front

NRIC back

Latest EPF statement showing 12 months contribution OR latest 2 years Form BE with proof of tax receipt/latest 2 years LHDN summary sheet for E-Filing submission OR

Latest 3 months’ salary slips OR 6 months’ commission slips with salary or commission crediting.

Optional documents (e.g., rental income, proof of bonuses paid, cash investments - FD or Mutual Funds, etc.)

For Malaysians working in Singapore (SG)

- Latest CPF statement (Malaysians working in SG) showing 12 months contribution OR latest 2 years NOA Form

Proof of salary crediting for 3 months

Copy of SG work permit/pass/PR

For Self-Employed Applicants

NRIC front

NRIC back

Business Registration Document

Latest 1 year Form B with tax receipt OR latest 6 months company bank statements OR latest 2 years EPF statement (Sdn Bhd only)

Optional documents (e.g., latest 6 months’ salary slips/6 months commission slips with crediting proof, rental income, etc.)

Q1: Do I have to pay on time every month?

A1: Yes, you have to pay your monthly instalment on time by the due date every month to enjoy the Pay-On-Time rebate.

Tip: Set up a monthly recurring payment for the month instalment before the due date.

Q2: What if I don't pay on time?

A2: Your eligibility for the Pay-On-Time rebate will be disqualified and subsequent rebate payments will be immediately terminated.

Q3: What if my verified monthly income in below RM8,000?

A3: You will not be eligible for the Pay-On-Time Rebate Campaign.

Q4: What if I want to make an early settlement prior to the maturity of the facility tenure?

A4: Your eligibility for the Rebate will be disqualified and subsequent Rebate payments will be immediately terminated.

Q5: When will I recieve my Rebate.

A5: The Rebate will be credited monthly to your facility account starting after the 13th month's instalment due date and will continue each subsequent month until the 6th month before the final instalment of the facility. Therefore, the rebate period is typically 18 months less than the total facility tenure. During the Rebate Period, you will pay a lower monthly instalment.

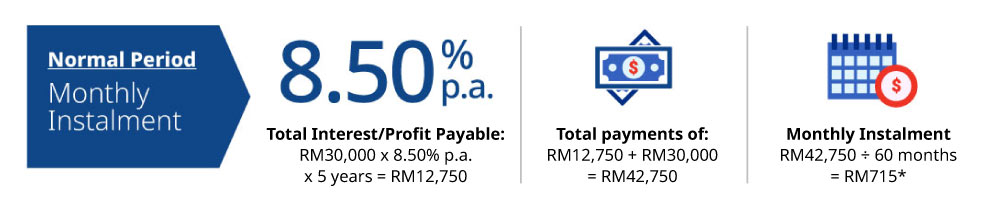

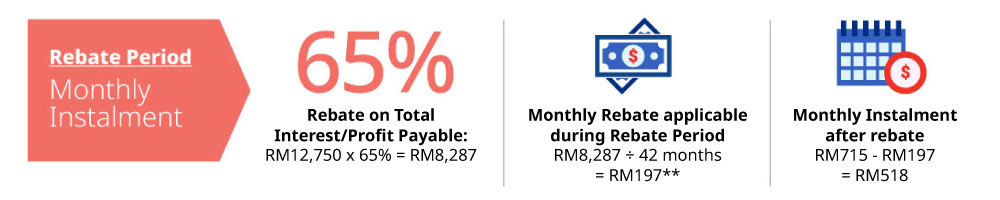

Q6: How do I calculate the Instalment Amount during Normal Period & Rebate Period?

A6: For example, your are a customer with a verified monthly income of RM8,000 and above with the disbursement to HLB CASA/HLISB CASA-i. The applicable interest/profit rate is 8.50% p.a. and your total approved facility amount is RM30,000 for a financing tenure of 5 years. You also qualify for 65% Pay-On-Time Rebate. This example is illustrated below:

*Monthly instalments will be rounded up to the nearest RM5.

** Monthly rebates will be credited into your account monthly during the Rebate Period and will be rounded down to the nearest RM1.

Any discrepancies in the toal settlement amount and in the total savings due to rounding of monthly instalments and monthly rebates will be adjusted in the final month of the Rebate Period and on the final month of the Normal Period.

Q7: What if I don't maintain a cumulative daily balance of RM500 in my HLB/HLISB CASA/CASA-i for the first thirteen (13) months from the first month instalment due date.

A7: Your eligibility for the Rebate will be disqualified and subsequent Rebate payments will be immediately terminated.

Tip: Earmark RM500 in your HLB/HLISB CASA/CASA-i for the first thirteen months to avoid disqualification and the loss of rebate payments.