Salary Advance Employer Solution

Hong Leong Bank is now enabling the most desired employee benefit to you.

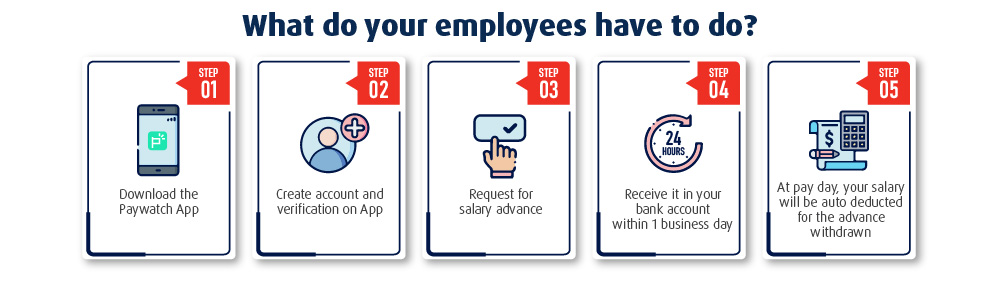

Salary Advance Employer Solution is an earned wage access service by Hong Leong Bank and powered by Paywatch that enables an employer to offer their employees salary advances up to 25% of their earned salary at any point of time. This means any day is payday for your employees - all for a Service Fee of RM2 per withdrawal.

Your employees are your most valuable asset. This solution is here to help you take care of your employees by offering them the most desired benefit – daily access to their earned pay.

No new HLB account opening required.

No interest rate or late fee charges. Now your employees can get paid any time they have earned their wages.

Paywatch is a platform that partners with corporates to provide employees instant access to their earnings.

To learn more about Paywatch, visit https://www.paywatch.com.my

- This Solution is now available for companies to sign up.

- Click “Find Out More” to set an appointment with us to find out more about this Solution for your company.

Earned wage access (EWA) solution enables corporates to provide their employees the access to withdraw a portion of their earned wages before payday. Unlike the traditional payroll system where employees are paid once at the end of the month, the employee has the flexibility to withdraw a portion of the amount they have earned anytime.

Here’s the difference between EWA solution and the traditional payroll system

Example: Sarah is an employee of XYZ Sdn Bhd and is earning a monthly salary of RM2,000

Traditional Payroll System |

Earned Wage Access Solution by HLB |

|---|---|

Sarah receives her salary on her payday (the last day of every month) |

Sarah has worked for 50 hours and has earned RM400 so far. |

Sarah can withdraw up to RM100 anytime (25% of her earned wages) |

How does the EWA Solution by HLB help?

• The EWA solution by HLB and powered by Paywatch allows employees to access their earned salaries through flexible payout dates which serve as an alternative source of funds for emergency situations or unexpected expenses.

• Employees will only be charged RM2 fee per withdrawal if they are to withdraw their earned wages.