People also viewed these

Features & Benefits

Contactless Functionality

Your default contactless transaction limit is RM250. Make contactless transactions for purchases below RM250 without having to enter a PIN.

The contactless cumulative limit resets on a daily basis. For additional security, every time you perform a total of RM800 contactless transactions cumulatively, you will be asked to perform a contact transaction and key in your PIN to reset your contactless cumulative limit.

Once you have entered your PIN, your cumulative contactless limit will be reset to zero. You will also receive Notifications via HLB Connect App or SMS notification upon every successful contactless transaction amounting to or exceeding RM200.

You may reset your contactless transaction limit and your cumulative contactless limit from RM0-RM800 by visiting any HLB/HLISB branch.

More details

Less details

Your default contactless transaction limit is RM250. Make contactless transactions for purchases below RM250 without having to enter a PIN.

The contactless cumulative limit resets on a daily basis. For additional security, every time you perform a total of RM800 contactless transactions cumulatively, you will be asked to perform a contact transaction and key in your PIN to reset your contactless cumulative limit.

Once you have entered your PIN, your cumulative contactless limit will be reset to zero. You will also receive Notifications via HLB Connect App or SMS notification upon every successful contactless transaction amounting to or exceeding RM200.

You may reset your contactless transaction limit and your cumulative contactless limit from RM0-RM800 by visiting any HLB/HLISB branch.

More details

Less details

Enable Debit Card for Overseas Transactions, Auto Debit and Internet Purchases

Effective 30 December 2015, all Overseas Transactions, Auto Debit and Internet Purchase (non-3D secure transactions) using Hong Leong Debit Card have been blocked as a security measure in line with Bank Negara Malaysia's regulation. Debit Cardholders are required to activate these services before they can perform the above transactions.

More details

Less details

Effective 30 December 2015, all Overseas Transactions, Auto Debit and Internet Purchase (non-3D secure transactions) using Hong Leong Debit Card have been blocked as a security measure in line with Bank Negara Malaysia's regulation. Debit Cardholders are required to activate these services before they can perform the above transactions.

More details

Less details

Transaction Limit Notifications via HLB Connect App or SMS Alert

Cardholders who would like to change their transaction limit Notifications via HLB Connect App or SMS alert are required to write in for request to change the pre-determined amount/limit or totally opt out of this transaction limit Notifications via HLB Connect App or SMS alert service.

Cardholder can obtain the Debit Card/Debit Card-i transaction Alert Service Maintenance Form (“Form”) from the nearest HLB branches or at www.hlb.com.my in order to change his/her transaction limit Notifications via HLB Connect App or SMS alert/opt out the transaction limit Notifications via HLB Connect App or SMS alert service.

Click here, to download form.

More details

Less details

Cardholders who would like to change their transaction limit Notifications via HLB Connect App or SMS alert are required to write in for request to change the pre-determined amount/limit or totally opt out of this transaction limit Notifications via HLB Connect App or SMS alert service.

Cardholder can obtain the Debit Card/Debit Card-i transaction Alert Service Maintenance Form (“Form”) from the nearest HLB branches or at www.hlb.com.my in order to change his/her transaction limit Notifications via HLB Connect App or SMS alert/opt out the transaction limit Notifications via HLB Connect App or SMS alert service.

Click here, to download form.

More details

Less details

The Debit Card never leaves your hand

The most simple security measure for a contactless Debit Card is the fact that it never leaves your hand. Because you’re in control of the payment, there’s no chance that someone will double swipe or make a copy of your Debit Card when you’re not looking.

Secure chip to prevent counterfeit

Contactless Debit Cards are as secure as any other chip-enabled Debit Card and carry the same multiple layers of security to prevent counterfeit. Each contactless transaction includes a unique code generated by the chip in the Debit Card that changes with each purchase, thereby preventing fraudsters from replaying information read from the chip to make payments.

Customer verification for higher value purchases

As contactless technology is designed to offer customers speed and convenience at the cashier, you do not need to sign or enter a PIN for contactless transactions up to RM250 in Malaysia. If the transaction is more than RM250, you can still tap the Debit Card but will be required to enter your PIN or be asked to sign the receipt.

No Cardholder Liability for Contactless Purchases

In the unlikely event of fraud, you will not be held responsible for fraudulent charges or unauthorised purchases made using the contactless feature on your chip Debit Card. You must notify us immediately or as soon as reasonably possible of any unauthorised Debit Card use or any suspicious activities. However, you may be held responsible for unauthorised purchases if you were negligent with protecting your Debit Card or your PIN.

Q: What is PIN?

A: A PIN, or Personal Identification Number, is a secret code either issued by HLB/HLISB to the Cardholder upon request or selected by the Cardholder at any HLB/HLISB’s branches in accordance with the application procedures on ATM services and includes changes on the same day made by the Cardholder as the case may be, from time to time. This PIN can be used for making purchases at retail shops and to perform cash withdrawal as well as transactions at all Automated Teller Machine (“ATM”) In short, a PIN is required to authenticate and complete a Debit Card transaction be it at ATM, Point-of-Sale (“POS”) or any type of payment devices that requires a PIN.

Q: Why is PIN safer than signing?

A: PIN usage can help protect against fraud due to lost or stolen cards as the PIN is only known to Cardholder. The risk of signature being faked/forged is reduced accordingly. Therefore, PIN has to be protected in a highly secured manner and not to be disclosed to any third party.

Q: How do I keep my PIN secured?

A: Some measures to keep your PIN confidential and safe include:

- Do not use numbers associated with birthday or anniversary date, phone number, IC no., driver’s license as the PIN;

- Do not keep a written record of the PIN;

- Do not allow any third party to see your PIN when it is entered or displayed;

- Do not keep the PIN in a form that can be readily identified as a PIN;

- Do not disclose the PIN to any third party (including persons in apparent authority, family members or spouse);

- Do not negligently or recklessly disclose your PIN; and

- Notify the Bank if the PIN has become known to someone else and change the PIN immediately.

Q: Why do I need to change my current Chip & Signature ("C&S") Debit Card to the new P&P Debit Card?

A: All Banks are mandated by Bank Negara Malaysia (“BNM”) to get the Cardholders to change their existing C&S Debit Card to the new P&P Debit Card by 31 December 2016 or the date specified in the SMS or ATM Screen.

Q: What happens if I do not change my C&S Debit Card?

A: After the stipulated deadline for change, your C&S Debit Card will no longer be valid for use. You may not be able to perform retail purchases and ATM transactions (including cash withdrawal).

Q: Can I request HLB to send the new P&P Debit Card to me?

A: No, you are required to visit any HLB/HLISB’s branches to personally change your C&S Debit Card to the new P&P Debit Card.

Q: What is the difference between my current C&S Debit Card and the new P&P Debit Card?

A: The P&P Debit Card is a secured PIN-enabled Debit Card which requires the Cardholders to key in a PIN to perform a POS transaction.

Q: How do I differentiate a HLB’s C&S and P&P Debit Card?

A: HLB/HLISB’s P&P Debit Card has the Malaysian Chip Card Specification (“MCCS”) Contactless logo (and the Visa payWave logo for HLB Debit Cards only) as well as MyDebit logo at the top and middle right of the Debit Card respectively. A sample of P&P and C&S Debit Cards are as shown below:

P&P Debit Card (New)

C&S Debit Card (Old)

Q: I am currently transacting with PIN, what is the difference?

A: The PIN-based transaction that you are transacting now is via MyDebit/MEPS (or Debit) line while signature (on the transaction receipt) is via VISA/MasterCard. Moving forward and/or effective 1 January 2017, all transactions will be PIN based regardless via MyDebit, MEPS, VISA or MasterCard line.

Q: Is the PIN the same for both ATM and POS transaction?

A: Yes, as stated in No.1 herein.

Q: Can I request to have 2 different PIN for ATM and POS transactions?

A: No.

Q: Am I required to enter PIN whenever I use my new P&P Debit Card in Malaysia?

A: Yes, if you are prompted by the merchants to enter the PIN. Please be informed that effective 1 January 2017, all payment transactions performed via POS and/or other payment devices will require PIN.

Q: Is the PIN required for Debit Card’s Card-Not-Present transactions (Auto Debit, Mail Order Telephone Order and/or online purchase)?

A: No, it is not required. The PIN is to be used at ATMs, POS terminals and/or other payment devices only. For secured online transactions, the Cardholders are required to key in the VISA Secured or MasterCard Secured one-time password (OTP) instead, which will be sent to their mobile phone to authorise the transactions.

Q: What happens if I use my new P&P Debit Card at a POS terminal not supporting PIN?

A: The POS terminal will process the transaction with your P&P Debit Card without prompting for PIN and you will be required to sign on the transaction receipt to complete the transaction.

Q: Do I need to enter a PIN at a self-service kiosk or terminal (i.e. petrol station) in Malaysia?

A: If the self-service kiosk or terminal supports PIN, it will prompt you to enter a PIN when you insert your card into the terminal. If you do not know, or if you do not have a PIN enabled card, you may proceed indoors to the shop to pay at the attended terminal with signature.

Q: Can I use my P&P Debit Card in countries that are on magnetic stripe (example United States of America)?

A: Yes, the P&P Debit Card can be used globally where there is acceptance of payment brands of VISA or MasterCard.

Q: Am I required to enter PIN for a pre-authorized transaction (e.g hotel check-in)?

A: Yes.

Q: Am I required to enter PIN when I return goods to merchants for refund?

A: No.

Q: Is there a fee imposed on changing my C&S Debit Card to the new P&P Debit Card?

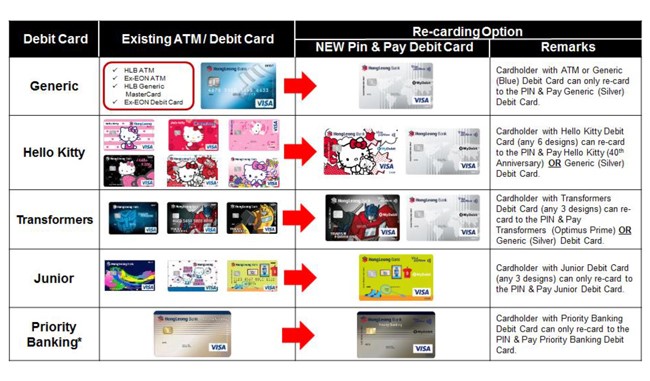

A: Please refer to the below table on the types of Debit Card which Cardholder may change without incurring any replacement card fee.

Q: Can the existing Generic Blue Debit Cardholders opt for the new P&P Hello Kitty Debit Card?

A: Yes, however a nominal fee will be charged.

Change of PIN

Q: Can I change my PIN (first or subsequent time) at other bank’s ATM?

A: No, you can only change your P&P Debit Card PIN at HLB’s ATM or login to Hong Leong Connect under "Other Services > Create PIN / Change PIN".

Q: Is there any ruling when it comes to assigning a PIN number the new P&P Debit Card?

A: No, but some measures/controls are highly encouraged as stated in No.3 herein.

Wrong/Forget PIN

Q: What happen if I’ve entered a wrong PIN?

A: Three attempts are allowed before your P&P Debit Card is blocked. When the Debit Card is blocked, you are required to visit any HLB/HLISB’s branches or log on to Hong Leong Connect Online Banking to reset your PIN.

Q: What happens if I’ve forgotten my PIN?

A: You may visit any HLB/HLISB branch to reset your PIN. Alternatively, you may log-on to Hong Leong Connect Online Banking to create a new PIN.

Petrol Transactions

Q: Can I use my new P&P Debit Card at the self-service petrol pump (outdoor kiosk) in Malaysia?

A: Yes, you can. If you are transacting at an upgraded PIN-enabled self-service petrol kiosk, you will be prompted to key in your 6-digit PIN to complete the payment with your P&P Debit Card.

If you are transacting at a non PIN-enabled self-service petrol kiosk, you will NOT be prompted to key in your PIN to complete the payment with your P&P Debit Card.

Q: Can I continue to use my C&S Debit Card at the self-service petrol pump (outdoor kiosk)?

A: Whether you can continue to use your C&S Debit Card at the self-service petrol pump/outdoor kiosk depends on the type of kiosk you are transacting.

If you are transacting at an upgraded PIN-enabled self-service petrol kiosk, you will be prompted to key in your 6-digit PIN. Without the 6-digit PIN, you will not be able to complete the payment with your C&S Debit Card. Therefore, you have to proceed to the indoor cashier counter to pay with your C&S Debit Card.

If you are transacting at a non PIN-enabled self-service petrol kiosk, you will NOT be prompted to key in your PIN, hence, you can complete your payment with your C&S Debit Card.

OVERSEAS

Q: I’m travelling abroad for holidays. Can I use my P&P Debit Card at retailers overseas?

A: Yes, you can. You can use your P&P Debit Card at any retailers worldwide that accept

VISA/MasterCard

Q: I’m travelling abroad for holidays with my new P&P Debit Card. What should I do prior to travelling?

A: You have to activate your new P&P Debit Card and select your preferred PIN, if you have not done so, before travelling abroad. When transacting via your new P&P Debit Card, you have to enter your 6-digit PIN when prompted by the POS terminal and/or the cashier.

Q: I’m travelling abroad for holidays with my P&P Debit Card. I have realized that I could not remember my 6-digit PIN, when transacting with my P&P Debit Card. What should I do now?

A: You have to request the retailer to by-pass PIN entry and use signature instead. To change your 6-digit PIN immediately, login to Hong Leong Connect by performing the following steps:

Step 1: Login at www.hongleonconnect.my

Step 2: Go to ‘Settings’ > ‘Manage Card PIN’ > ‘Create PIN/ Change PIN’

Step 3: Select Account > Enter ‘New PIN’ > Confirm ‘New PIN’

Step 4: Key-in TAC no > Click ‘Submit’

Q: I’m travelling abroad for holidays with my P&P Debit Card. I Q: I’m travelling abroad for holidays with my P&P Debit Card. I have my 6-digit PIN with me but the retailer informed me that the POS terminal is not PIN-enabled (accept signature only)/ the POS terminal can only accept 4-digit PIN. What should I do now?

A: You have to request the retailer to by-pass PIN entry and use signature instead.

Others

Q: Can I identify an authorized P&P Debit Card transaction on the Transaction Receipts and/or statement?

A: Yes, the transaction receipts and/or statement will display the word “PIN Verified”.

Q: Is the PIN printed on the transaction receipt?

A: No.

Q: Do I still need to sign on the reverse of my P&P Debit Card?

A: Yes, this is still necessary as the signature will continue to be used for verification in certain situations (e.g. travelling to a country where PIN is not used, where the terminals of merchants have not upgraded to support PIN-based transactions etc.).

Q: Will all merchants know how to process a P&P transaction?

A: All merchants will be trained to perform a P&P (PIN-based) transaction. This will be done over a period of time till 30 June 2017.

Q: Is signature still required on the Transaction Receipt after the PIN is entered?

A: Signature is not required on any Transaction Receipt once the PIN has been verified. The Sales Draft shall display the word “PIN Verified”.

Q: Is PIN required for Contactless Transactions?

A:

- PIN is not required for transactions up to RM250 in a single receipt. If the transaction exceeds RM250 in a single receipt, you are required to enter your PIN.

- For cumulative contactless limits, you are able to perform up to RM800. Once you have reached the cumulative contact limit, you are required to perform a contact transaction and key in PIN to reset your cumulative limit.

IMPORTANT NOTICE

Enable Debit Card for Overseas Transactions, Auto Debit and Internet Purchases

Dear Debit Cardholders,

Effective 30 December 2015, all Overseas ATM Withdrawal and Overseas Purchases, Mail Order/ Telephone Order, Auto Debit and Internet Purchase (non-3D secure transactions) using Hong Leong Debit Card have been blocked as a security measure in line with Bank Negara Malaysia’s regulation.

Debit Cardholders are required to activate these services before they can perform the above transactions.

You can enable these transactions conveniently via the following channels:-

1. Hong Leong Connect Internet Banking

- Log on to www.hongleongconnect.my

- Under “Other Services” menu, go to “Card Settings” and select “Overseas Withdrawal & Debit Card Settings”

- Click on the toggle button of the relevant services to opt in

- An AppAuthorise notification or TAC will be sent to your mobile phone

- Tap “Authorise” on the AppAuthorise screen or enter the TAC, click “Confirm” and you’re done!

2. Hong Leong Connect Mobile App

- Log on to Hong Leong Connect Mobile App

- Click on the CURRENT/SAVINGS ACCOUNT, click on the “SERVICES” tab and click on “Debit Card Settings”

- Click on the toggle button of the relevant services

- An AppAuthorise notification or TAC will be sent to your mobile phone

- Tap “Authorise” on the AppAuthorise screen or enter the TAC, click “Confirm” and you’re done!

3. HLB/HLISB ATM

- Insert your Debit Card

- Press “Debit Card Service Activation / Deactivation”

- Select the relevant services

- Select “Activate” (opt-in) and you’re done!

4. Contact Hong Leong Call Centre at 03-7626 8899

5. Go to any of our Branches during banking hours

This move is IMPORTANT to prevent fraud and further protect Cardholders from becoming victims of fraudsters.

Thank you.

Q: What is the definition of Card-Not-Present (“CNP”) transactions?

A: CNP transaction is a card transaction made whereby a Cardholder is not physically present (i.e. non Face-to-Face) at the merchant when the payment is made. Examples of CNP transactions are Internet Purchase (non-3D secure transaction), Mail Order Telephone Order and Auto Debit.

Q: What is the definition of Overseas transaction?

A: An Overseas transaction is a transaction that is performed outside of the country (i.e. out of Malaysia). Overseas transactions include Point-of-Sale (“POS”) transactions and cash withdrawals that are made at ATMs outside of Malaysia.

Q: Why am I required to provide my consent to perform CNP and Overseas Transactions?

A: This is pursuant to new regulations that have been imposed by Bank Negara Malaysia which mandated all financial institutions and issuers to default and/or block any Debit Cardholders from making any CNP transactions that are not authenticated via strong authentication method such as dynamic password or any Overseas transactions using a Debit Card UNLESS the Debit Cardholder has expressly opted-in to perform such transactions. The requirement to opt-in seeks to ensure that adequate risk management measures and controls are in place among financial institutions and issuers, and to educate Debit Cardholders on the safe practices in order to mitigate the risks of unauthorized transactions, in particular CNP and Overseas transactions.

Q: What is considered as a Internet Purchase that is non-3D secure?

A: An Internet Purchase that is non-3D secure is a transaction that only requires Debit Cardholder to use the details on the card (i.e: Card Number, Expiry Date and CVV) to transact. In comparison, an Internet Purchase that is 3D secure requires the details on the card and One Time Password (“OTP”) to authorize the transaction.

transactions.

Q: Can I opt-in only for Non-3D Secure Internet Purchases and not Overseas transactions?

A: Yes, Debit Cardholder may choose to opt in to any of these four (4) types of transactions: i. Non-3D Secure Internet Purchase ii. Mail Order / Telephone Order (MOTO) / Auto Debit iii. Overseas Retail Purchase iv. Overseas ATM withdrawal

Q: How can I opt-in to perform CNP and Overseas Transaction?

A: You may choose to opt in from the following channels:-

- Hong Leong Connect at www.hongleongconnect.my

- Hong Leong Connect Mobile App

- HLB/HLISB ATM

- Call Centre – 03 7626 8899

- HLB/HLISB Branches during banking hours

Q: If I am holding a Hong Leong ATM card, do I need to opt in as well?

Q: If I am residing Overseas, how can I opt in to perform such transactions?

Q: If I opt in to perform CNP and Overseas transactions, will it be effective immediately?

Q: Will this affect my existing recurring transactions (i.e: Auto Debit for insurance/utilities, etc.) if I do not perform the opt-in?

Q: What is the risk associated to CNP and Overseas transactions?

A: When a CNP and/or Overseas transaction is performed, there is a risk of your account data being compromised or the information being used for unauthorized purchases and/or cash withdrawals. Please be reminded that in the case of Overseas transactions, the card verification features for POS transactions may vary from country to country and some countries/merchants may not adopt a more stringent approach. Fraudulent transactions may occur if your account data is compromised.

Click here for the list of fees and charges, or visit any of our branches for further information.