Debit Card

How to make purchases with your Debit Card?

- Look out for retailers that display the VISA/MasterCard/MyDebit logo or with Point-of-Sales (POS) terminal.

- At the payment counter, allow the cashier to assist and to pay using your Debit Card via contactless transaction or chip & PIN transaction method into the POS terminal. For contactless transaction, you are required to tap your Debit Card on the contactless terminal. For chip & PIN transaction, you are required to chip in your Debit Card into the terminal and enter your PIN.

- For contactless transaction of RM250 and below, no PIN is required.

- Once transaction is completed, always remember to take back your Debit Card.

How your Debit Card will be accepted by a retailer?

- Your Hong Leong Debit Card supports two (2) Debit Card brands – either Visa/Master and MyDebit which allows your card to be accepted both overseas and in Malaysia. By supporting both of these Debit Card brands, there are more retail outlets that will accept your Debit Card for payment in Malaysia and overseas.

- When using your Hong Leong Debit Card at retailers in Malaysia, a retailer may choose to accept and process the payment on your card using either MyDebit, VISA or MasterCard. This is the retailer’s choice and allows the retailer to process the payment via their chosen Debit Card network. Please be aware that you are not able to request the retailer to change their chosen Debit Card network.

Do's

Immediately sign on the signature panel at the back of your Debit Card upon receipt.

Personal Identification Number (“PIN”) change at the Automated Teller Machine (“ATM”) is required before you can perform any transaction using your Debit Card.

Treat, value and protect your Debit Card as if they were cash, keep your Debit Card secured and ensure that it is in your possession at all times.

When using your Debit Card at any merchant establishment, ensure that all details have been entered correctly and completed before signing the charge slip/transaction slip or keying in your PIN. This PIN is the same as the ATM PIN you use to perform ATM transactions.

Ensure that your spending is within the default limit of RM2,000 per day to avoid transactions being rejected. To change your limit, please visit www.hongleongconnect.my.

Check and ensure that the Debit Card you received after a transaction at a merchant is yours.

Ensure that you authorize all use of Debit Card (face-to-face or on Phone/Internet).

When purchasing items over the Internet, give your Debit Card details only on reliable websites and is from a company you trust. Reputable merchant sites use encryption technologies to protect your Debit Card information.

Avoid using a public computer to shop online. If you do, please remember to log off and quit the browser when you are finished. All it takes is for someone to hit the "back button" to view your personal information.

Always print and save the confirmation page when completing an online purchase.

Record or keep your receipts for all your purchases including online purchases.

Shred all documents (charge slip, statement etc.) that contains Debit Card details before you discard them.

Void incorrect charge slips before you sign a new one.

Promptly check your Debit Card statement and report immediately if there are any transactions that you do not recognize or unauthorized by you.

Keep the Bank’s phone numbers readily available with you to immediately report any lost or stolen of your Debit Card. Always check your Debit Card periodically to ensure that the Debit Card is not missing from your wallet.

Notify the Bank promptly for any change of your contact details by visiting the Bank’s branches or calling the Bank’s Call Centre at 03-7626 8899, especially your handphone number and e-mail address so that the Bank can perform verification of unusual or suspicious transactions. This will also enable the Bank to contact you for any important notices or marketing campaigns (for Cardholder who has opt-in to receive marketing/promotion) in the future.

Be wary of high-pressure sales tactics such as "SCRATCH & WIN" where they ask for your Debit Card details.

When you received a call from a Telemarketer asking questions, the fewer questions the Telemarketer can answer, more likely they are calling from an illegitimate business. Should you feel suspicious of the phone call, kindly contact the number stated behind your Debit Card to verify whether the call is genuine from the Bank.

If you are travelling Overseas, you are required to inform the Bank to opt-in for Overseas transactions and/or ATM withdrawal. Failing which, your Overseas transactions and/or ATM withdrawal will be declined. This requirement is applicable for both Hong Leong Debit and ATM Card.

You are also required to inform the Bank to opt-in should you want to perform any online (non-3D Authenticated website) and/or Mail Order/Telephone Order (“MOTO”)/Auto Debit transactions. Failing which, your online transaction and/or MOTO/Auto Debit transactions will be declined.

Note that when you opt-in for Card-Not-Present (i.e Online, Auto Debit) and/or Overseas transaction, there is a risk of your account data being compromised or the information being used for unauthorized purchases and/or cash withdrawals. Please be reminded that in the case of Overseas transactions, the card verification features for Point-of-Sales transactions may vary from country to country and some countries/merchants may not adopt a more stringent approach. Fraudulent transactions may occur if your account data is compromised.

You may, at any time, opt-out from Card-Not-Present and/or Overseas transaction from Hong Leong Connect / branches / ATMs / Hong Leong Call Centre

Don'ts

- Never leave your Debit Card in an unsecured place, including but not limited to glove compartment of your car, lying around at home or in the office where someone can have access to it. If you do not want to use your Debit Card, keep it in a safe and secure place.

Do not disclose personal details or your Debit Card’s details to any third/unknown party.

The Bank will never send you an email or letter asking for your Debit Card’s information.

Never reveal your username, password, security questions or answers, and/or PIN to anyone. You should not respond to such emails, letters, websites or phone numbers. No one needs to know your PIN, not even the Bank. Do not respond to emails that ask you to go to a website to verify your personal and/or Debit Card’s information.

Never send Debit Card’s information, such as PIN or retail purchase account numbers etc. in an e-mail as it may be intercepted.

Watch out for imposters/fraudsters that claim to be from the Bank and ask to "verify" your Debit Card’s details to make sure you are protected. The Bank does not need your account details as the Bank already has your details.

When selecting a PIN, always avoid the obvious, such as telephone number, date of birth, identity card number etc. Do not keep a copy of your PIN in your wallet/purse.

Never provide your Debit Card’s information on a website where a link is provided in a suspicious email.

Never provide your Debit Card’s information online unless you are making a purchase.

Never sign on a blank charge slip/transaction receipt. When you sign a charge slip/transaction receipt, draw a line through the blank space above the total spending amount.

Do not give or lend your Debit Card to anyone. Your Debit Card is not transferable and is your obligation to keep it secured.

Q: What is PIN?

A: A PIN, or Personal Identification Number, is a secret code either issued by HLB/HLISB to the Cardholder upon request or selected by the Cardholder at any HLB/HLISB’s branches in accordance with the application procedures on ATM services and includes changes on the same day made by the Cardholder as the case may be, from time to time. This PIN can be used for making purchases at retail shops and to perform cash withdrawal as well as transactions at all Automated Teller Machine (“ATM”) In short, a PIN is required to authenticate and complete a Debit Card transaction be it at ATM, Point-of-Sale (“POS”) or any type of payment devices that requires a PIN.

Q: Why is PIN safer than signing?

A: PIN usage can help protect against fraud due to lost or stolen cards as the PIN is only known to Cardholder. The risk of signature being faked/forged is reduced accordingly. Therefore, PIN has to be protected in a highly secured manner and not to be disclosed to any third party.

Q: How do I keep my PIN secured?

A: Some measures to keep your PIN confidential and safe include:

- Do not use numbers associated with birthday or anniversary date, phone number, IC no., driver’s license as the PIN;

- Do not keep a written record of the PIN;

- Do not allow any third party to see your PIN when it is entered or displayed;

- Do not keep the PIN in a form that can be readily identified as a PIN;

- Do not disclose the PIN to any third party (including persons in apparent authority, family members or spouse);

- Do not negligently or recklessly disclose your PIN; and

- Notify the Bank if the PIN has become known to someone else and change the PIN immediately.

Q: Why do I need to change my current Chip & Signature ("C&S") Debit Card to the new P&P Debit Card?

A: All Banks are mandated by Bank Negara Malaysia (“BNM”) to get the Cardholders to change their existing C&S Debit Card to the new P&P Debit Card by 31 December 2016 or the date specified in the SMS or ATM Screen.

Q: What happens if I do not change my C&S Debit Card?

A: After the stipulated deadline for change, your C&S Debit Card will no longer be valid for use. You may not be able to perform retail purchases and ATM transactions (including cash withdrawal).

Q: Can I request HLB to send the new P&P Debit Card to me?

A: No, you are required to visit any HLB/HLISB’s branches to personally change your C&S Debit Card to the new P&P Debit Card.

Q: What is the difference between my current C&S Debit Card and the new P&P Debit Card?

A: The P&P Debit Card is a secured PIN-enabled Debit Card which requires the Cardholders to key in a PIN to perform a POS transaction.

Q: How do I differentiate a HLB’s C&S and P&P Debit Card?

A: HLB/HLISB’s P&P Debit Card has the Malaysian Chip Card Specification (“MCCS”) Contactless logo (and the Visa payWave logo for HLB Debit Cards only) as well as MyDebit logo at the top and middle right of the Debit Card respectively. A sample of P&P and C&S Debit Cards are as shown below:

P&P Debit Card (New)

C&S Debit Card (Old)

Q: I am currently transacting with PIN, what is the difference?

A: The PIN-based transaction that you are transacting now is via MyDebit/MEPS (or Debit) line while signature (on the transaction receipt) is via VISA/MasterCard. Moving forward and/or effective 1 January 2017, all transactions will be PIN based regardless via MyDebit, MEPS, VISA or MasterCard line.

Q: Is the PIN the same for both ATM and POS transaction?

A: Yes, as stated in No.1 herein.

Q: Can I request to have 2 different PIN for ATM and POS transactions?

A: No.

Q: Am I required to enter PIN whenever I use my new P&P Debit Card in Malaysia?

A: Yes, if you are prompted by the merchants to enter the PIN. Please be informed that effective 1 January 2017, all payment transactions performed via POS and/or other payment devices will require PIN.

Q: Is the PIN required for Debit Card’s Card-Not-Present transactions (Auto Debit, Mail Order Telephone Order and/or online purchase)?

A: No, it is not required. The PIN is to be used at ATMs, POS terminals and/or other payment devices only. For secured online transactions, the Cardholders are required to key in the VISA Secured or MasterCard Secured one-time password (OTP) instead, which will be sent to their mobile phone to authorise the transactions.

Q: What happens if I use my new P&P Debit Card at a POS terminal not supporting PIN?

A: The POS terminal will process the transaction with your P&P Debit Card without prompting for PIN and you will be required to sign on the transaction receipt to complete the transaction.

Q: Do I need to enter a PIN at a self-service kiosk or terminal (i.e. petrol station) in Malaysia?

A: If the self-service kiosk or terminal supports PIN, it will prompt you to enter a PIN when you insert your card into the terminal. If you do not know, or if you do not have a PIN enabled card, you may proceed indoors to the shop to pay at the attended terminal with signature.

Q: Can I use my P&P Debit Card in countries that are on magnetic stripe (example United States of America)?

A: Yes, the P&P Debit Card can be used globally where there is acceptance of payment brands of VISA or MasterCard.

Q: Am I required to enter PIN for a pre-authorized transaction (e.g hotel check-in)?

A: Yes.

Q: Am I required to enter PIN when I return goods to merchants for refund?

A: No.

Q: Is there a fee imposed on changing my C&S Debit Card to the new P&P Debit Card?

A: Please refer to the below table on the types of Debit Card which Cardholder may change without incurring any replacement card fee.

Q: Can the existing Generic Blue Debit Cardholders opt for the new P&P Hello Kitty Debit Card?

A: Yes, however a nominal fee will be charged.

Change of PIN

Q: Can I change my PIN (first or subsequent time) at other bank’s ATM?

A: No, you can only change your P&P Debit Card PIN at HLB’s ATM or login to Hong Leong Connect under "Other Services > Create PIN / Change PIN".

Q: Is there any ruling when it comes to assigning a PIN number the new P&P Debit Card?

A: No, but some measures/controls are highly encouraged as stated in No.3 herein.

Wrong/Forget PIN

Q: What happen if I’ve entered a wrong PIN?

A: Three attempts are allowed before your P&P Debit Card is blocked. When the Debit Card is blocked, you are required to visit any HLB/HLISB’s branches or log on to Hong Leong Connect Online Banking to reset your PIN.

Q: What happens if I’ve forgotten my PIN?

A: You may visit any HLB/HLISB branch to reset your PIN. Alternatively, you may log-on to Hong Leong Connect Online Banking to create a new PIN.

Petrol Transactions

Q: Can I use my new P&P Debit Card at the self-service petrol pump (outdoor kiosk) in Malaysia?

A: Yes, you can. If you are transacting at an upgraded PIN-enabled self-service petrol kiosk, you will be prompted to key in your 6-digit PIN to complete the payment with your P&P Debit Card.

If you are transacting at a non PIN-enabled self-service petrol kiosk, you will NOT be prompted to key in your PIN to complete the payment with your P&P Debit Card.

Q: Can I continue to use my C&S Debit Card at the self-service petrol pump (outdoor kiosk)?

A: Whether you can continue to use your C&S Debit Card at the self-service petrol pump/outdoor kiosk depends on the type of kiosk you are transacting.

If you are transacting at an upgraded PIN-enabled self-service petrol kiosk, you will be prompted to key in your 6-digit PIN. Without the 6-digit PIN, you will not be able to complete the payment with your C&S Debit Card. Therefore, you have to proceed to the indoor cashier counter to pay with your C&S Debit Card.

If you are transacting at a non PIN-enabled self-service petrol kiosk, you will NOT be prompted to key in your PIN, hence, you can complete your payment with your C&S Debit Card.

OVERSEAS

Q: I’m travelling abroad for holidays. Can I use my P&P Debit Card at retailers overseas?

A: Yes, you can. You can use your P&P Debit Card at any retailers worldwide that accept

VISA/MasterCard

Q: I’m travelling abroad for holidays with my new P&P Debit Card. What should I do prior to travelling?

A: You have to activate your new P&P Debit Card and select your preferred PIN, if you have not done so, before travelling abroad. When transacting via your new P&P Debit Card, you have to enter your 6-digit PIN when prompted by the POS terminal and/or the cashier.

Q: I’m travelling abroad for holidays with my P&P Debit Card. I have realized that I could not remember my 6-digit PIN, when transacting with my P&P Debit Card. What should I do now?

A: You have to request the retailer to by-pass PIN entry and use signature instead. To change your 6-digit PIN immediately, login to Hong Leong Connect by performing the following steps:

Step 1: Login at www.hongleonconnect.my

Step 2: Go to ‘Settings’ > ‘Manage Card PIN’ > ‘Create PIN/ Change PIN’

Step 3: Select Account > Enter ‘New PIN’ > Confirm ‘New PIN’

Step 4: Key-in TAC no > Click ‘Submit’

Q: I’m travelling abroad for holidays with my P&P Debit Card. I have my 6-digit PIN with me but the retailer informed me that the POS terminal is not PIN-enabled (accept signature only)/ the POS terminal can only accept 4-digit PIN. What should I do now?

A: You have to request the retailer to by-pass PIN entry and use signature instead.

Others

Q: Can I identify an authorized P&P Debit Card transaction on the Transaction Receipts and/or statement?

A: Yes, the transaction receipts and/or statement will display the word “PIN Verified”.

Q: Is the PIN printed on the transaction receipt?

A: No.

Q: Do I still need to sign on the reverse of my P&P Debit Card?

A: Yes, this is still necessary as the signature will continue to be used for verification in certain situations (e.g. travelling to a country where PIN is not used, where the terminals of merchants have not upgraded to support PIN-based transactions etc.).

Q: Will all merchants know how to process a P&P transaction?

A: All merchants will be trained to perform a P&P (PIN-based) transaction. This will be done over a period of time till 30 June 2017.

Q: Is signature still required on the Transaction Receipt after the PIN is entered?

A: Signature is not required on any Transaction Receipt once the PIN has been verified. The Sales Draft shall display the word “PIN Verified”.

Q: Is PIN required for Contactless Transactions?

A: PIN is not required for transactions up to RM250 in a single receipt. If the transaction exceeds RM250 in a single receipt, you are required to enter your PIN.

For cumulative contactless limits, you are able to perform up to RM400. Once you have reached the cumulative contact limit, you are required to perform a contact transaction and key in PIN to reset your cumulative limit.

IMPORTANT NOTICE

For seamless transactions with your debit card, please make sure to:

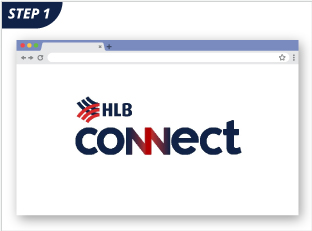

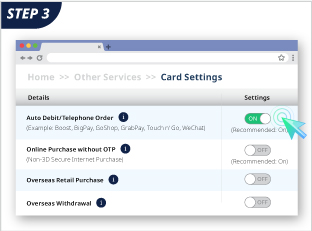

1. Enable the relevant services on HLB Connect:

a. Overseas Retail Purchase

b. Overseas ATM Withdrawal

c. Online Purchase without OTP

d. Auto Debit/Telephone Order

2. Set your own debit card transaction limit

3. Always ensure you have sufficient balance in your account before making payments

Enable Debit Card for Overseas, Online Spend and Auto Debit Transactions

HLB Connect App

Log in to HLB Connect App

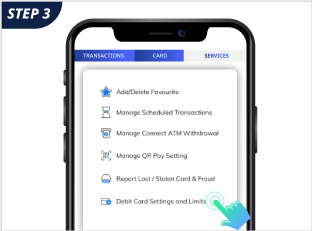

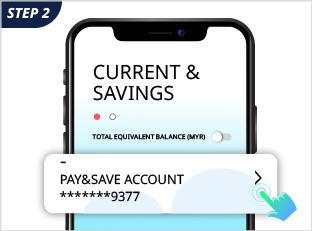

Click on the Current/Savings Account

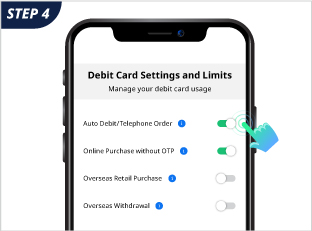

Click on Services, select Debit Card Settings and Limits

Click to enable/disable the relevant services

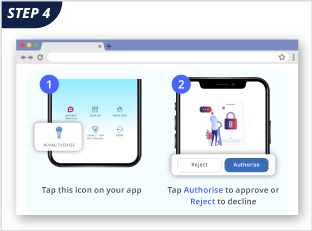

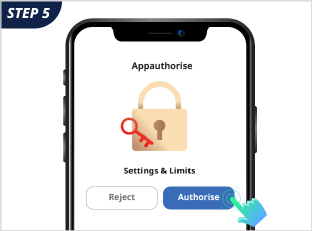

Authorise the request and you are done

Log in to HLB Connect Online

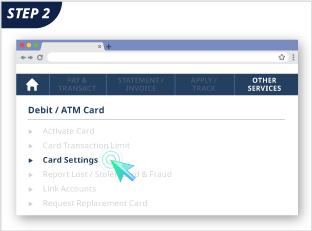

Under Other Services > Debit / ATM Card,

select Card Settings

Click to enable/disable the relevant services

Go to HLB Connect App, authorise the request and you are done

How do I change my Debit Card Transaction Limit

HLB Connect App

Log in to HLB Connect App

Click on the Current/Savings Account

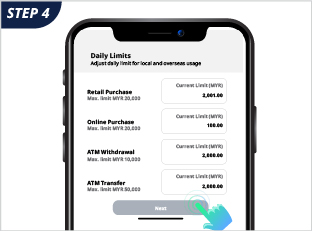

Click on ‘Card’ tab then Click on

Settings & Limits icon

Under Daily Limits, fill in the new amount in

relevant boxes and click Next

Authorise the request and you are done!

Log in to HLB Connect Online

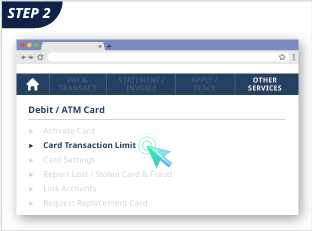

Under Other Services > Debit / ATM Card,

select Card Transaction Limit

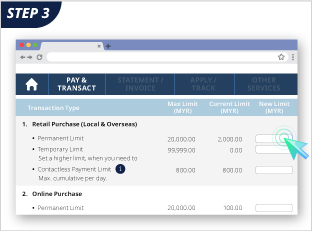

Fill in the amount under New Limit column

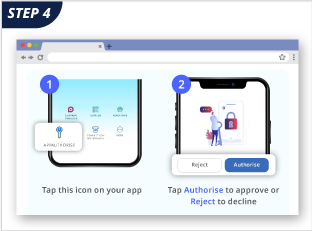

Go to HLB Connect App, authorise the request and you are done.

Q: What is the definition of Overseas transaction?

A: An Overseas transaction is a transaction that is performed outside of the country (i.e. out of Malaysia). Overseas transactions include Point-of-Sale (“POS”) transactions and cash withdrawals that are made at ATMs outside of Malaysia.

Q: What is the definition of Online purchase without OTP?

A: Online Purchase allows consumers to buy goods or services directly from a merchant through the internet (e.g. website/app) that do not requires 6-digits one-time password (OTP).

Q: Can I opt-in only for Online Purchase without OTP and not Overseas transactions?

A: Yes, Debit Cardholder may choose to opt in to any of these four (4) types of transactions as below:

a. Overseas Retail Purchase

b. Overseas ATM Withdrawal

c. Online Purchase without OTP

d. Auto Debit/Telephone Order

Q: If I am holding a Hong Leong ATM card, do I need to opt in as well?

A: You are required to opt in should you want to perform Overseas ATM withdrawal only.

Q: If I opt in to perform Overseas transactions, will it be effective immediately?

A: Yes, it will be of with immediate effect.

Q: Why am I required to provide my consent to perform Overseas, Online Purchase without OTP, Auto Debit/Telephone Order Transactions?

A: This is pursuant to regulations that have been imposed by Bank Negara Malaysia which mandated all financial institutions and issuers to default and/or block any Debit Cardholders from making any Online Purchase, Auto Debit/Telephone Order Transactions that are not authenticated via strong authentication method such as dynamic password or any Overseas transactions using a Debit Card unless the Debit Cardholder has expressly opted-in to perform such transactions. The requirement to opt-in seeks to ensure that adequate risk management measures and controls are in place among financial institutions and issuers, and to educate Debit Cardholders on the safe practices in order to mitigate the risks of unauthorized transactions.

Features & Benefits

Automatic Reload Function

Auto-reload RM50 when balance falls below RM50.

Pre-loaded of RM50

Pre-loaded with RM50. Debited from Debit Card Retail Purchase Account once the Debit Zing Card is issued.

Linked to Hong Leong Debit Card

Offer applicable only to Hong Leong Debit Cardholders. A sum of RM100 will be earmarked from the Retail Purchase Account

Free E-Statement

Free e-Statement via www.touchngo.com.my

Beyond the Road

Accepted use on public transport, carparks, Touch ’n Go merchants’ outlets, healthcare and many more.

Terms & Conditions

Frequently Asked Question

Q: What is Hong Leong Touch ‘n Go Debit Zing Card?

A: The Hong Leong Touch 'n Go Debit Zing Card is a Touch 'n Go Card with an automatic reload feature that is linked to your Hong Leong Current or Savings Account via Hong Leong Debit Card i.e. Debit Card Retail Purchase Account. Every time your Debit Zing Card balance falls below RM50, it will automatically reload RM50 and the amount will be debited from your Debit Card Retail Purchase Account.

Fees and Charges

Q: What are the fees and charges that will be imposed to the Hong Leong Touch 'n Go Debit Zing Card?

A:

Fees & Charges Description |

Fees & Charges* |

|---|---|

Auto Reload Fee |

RM0.50 per reload |

Maintenance Fee (Once every 6 months) |

RM5.00 |

*Subject to Government Tax, if applicable

- Maintenance Fee is referring to maintenance of the unutilised value at six (6) monthly intervals from the date the TNG Chip in the Zing Card is deemed inactive.

- Inactive means a Zing Card with no card transaction (reload or usage) for a period of twenty-four (24) consecutive months.

Q: How long will a refund process take if I wish to terminate the card and there is still balance amount in the Debit Zing Card?

A: It requires fourteen (14) working days and the balance amount will be credited back to your Debit Card Retail Purchase account.

Q: When will the earmark amount of RM100 to be released after customer requested to cancel the Debit Zing Card/Debit Card.

A: The RM100 will be released within fourteen (14) working days from the date the customer request is submitted.

Q: How many times can I reload my Hong Leong Touch 'n Go Debit Zing Card in a day?

A: Only one (1) auto reload allowed in a day.