Personal Loan/Financing-i | 01 January 2024-31 March 2024

*Applicable for applicants with a verified monthly income of RM8,000 and above and apply via the Bank’s Website.

Interest/Profit Rate for Online Application

Our rate is on a flat rate basis

Application Channel: Online (Bank’s Website) |

||

|---|---|---|

Verified Monthly Income |

Flat Interest/Profit Rate |

Facility Tenure |

RM2,000 – RM7,999 |

7.50% p.a. |

2 to 5 years |

RM8,000 and above |

5.50% p.a. |

|

Note: The effective interest/profit rates vary as follows for loan/financing-i tenure from 2 to 5 years:

(i) Flat interest/profit rate 5.50% p.a.: Effective interest/profit rates vary from 10.01% p.a. to 10.23% p.a.

(ii) Flat interest/profit rate 7.50% p.a.: Effective interest/profit rates vary from 13.32% p.a. to 13.80% p.a.

(iii) 0.50% of the facility amount will be deducted upon disbursement for stamp duty payable.

Illustration of Instalments

For example, you are an applicant with a verified monthly income of RM8,000 and above and you apply via the Bank’s Website. The applicable interest/profit rate is 5.50% p.a. and your total approved facility amount is RM100,000 for a financing tenure of 5 years. The above example is illustrated below:

*Monthly instalment amount will be rounded up to the nearest RM5.

Any adjustment due to rounding will be reflected towards the end of the facility tenure.

- Malaysian citizens aged between 21 to 60 years old

- Employed or self-employed with a minimum annual income of RM24,000.

- Minimum loan/financing amount is RM5,000

- Maximum loan amount is RM250,000 for Personal Loan and maximum financing amount for Personal Financing-i is RM150,000

- Exclusively for online applications only

Note: If you are an existing HLB Connect user, you may also login and apply via HLB Connect Online.

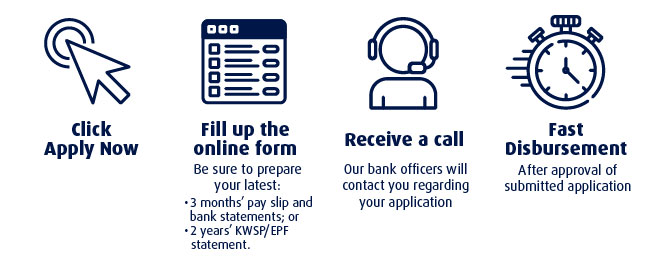

You will be prompted to upload the following 5 documents for your online application. Prepare these documents before you start your online application.

Accepted formats: .jpeg, .jpg, .pdf or .png

Max file size: 5MB per document

For Salaried Applicants (Fixed or Variable Income)

- NRIC front

- NRIC back

- Latest EPF statement showing 12 months contribution OR latest 2 years Form BE with proof of tax receipt/latest 2 years LHDN summary sheet for E-Filing submission OR

- Latest 3 months’ salary slips OR 6 months’ commission slips with salary or commission crediting.

- Optional documents (e.g., rental income, proof of bonuses paid, cash investments - FD or Mutual Funds, etc.)

For Malaysians working in Singapore (SG)

- Latest CPF statement (Malaysians working in SG) showing 12 months contribution OR latest 2 years NOA Form

- Proof of salary crediting for 3 months

- Copy of SG work permit/pass/PR

For Self-Employed Applicants

- NRIC front

- NRIC back

- Business Registration Document

- Latest 1 year Form B with tax receipt OR latest 6 months company bank statements OR latest 2 years EPF statement (Sdn Bhd only)

- Optional documents (e.g., latest 6 months’ salary slips/6 months commission slips with crediting proof, rental income, etc.)