Switch to e-Statement! Paper Statement Fee of RM2.00 will be charged for each paper statement of Deposit/-i & Loan/Financing-i account effective March 2025.

Benefits of Switching to e-Statement

Affected Products

- Deposit/-i (except for Basic Savings Account/-i & Basic Current Account/-i)

- Property Loan/Financing-i

- Auto Loan/Financing-i

- Personal Loan/Personal Financing-i

- ASB Financing-i

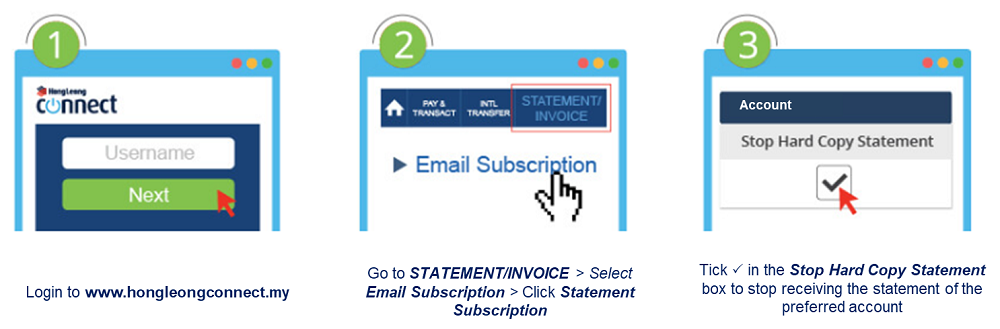

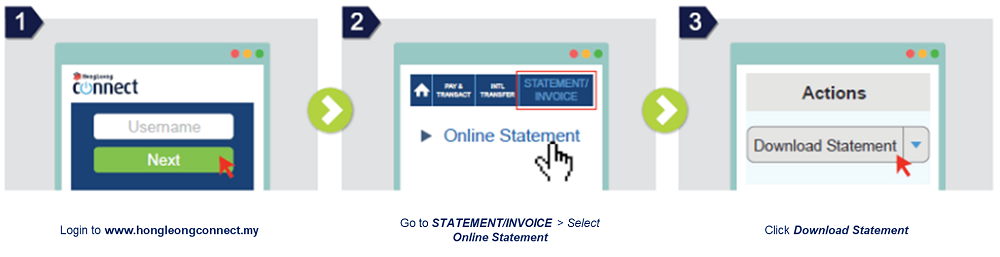

Steps to access your e-Statement

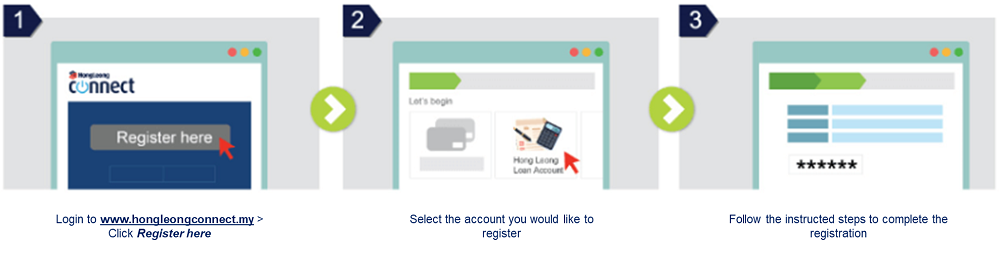

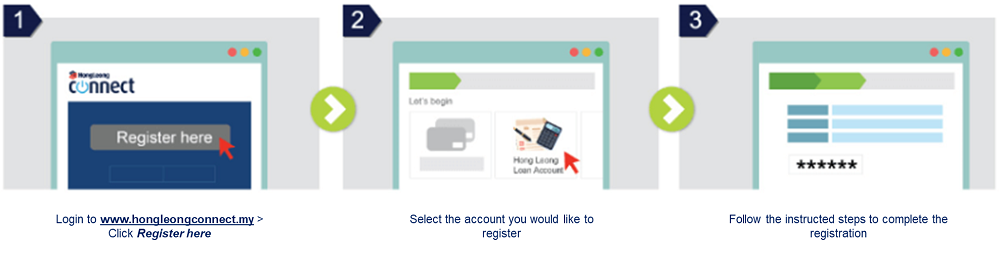

Step 1: Register HLB Connect Online

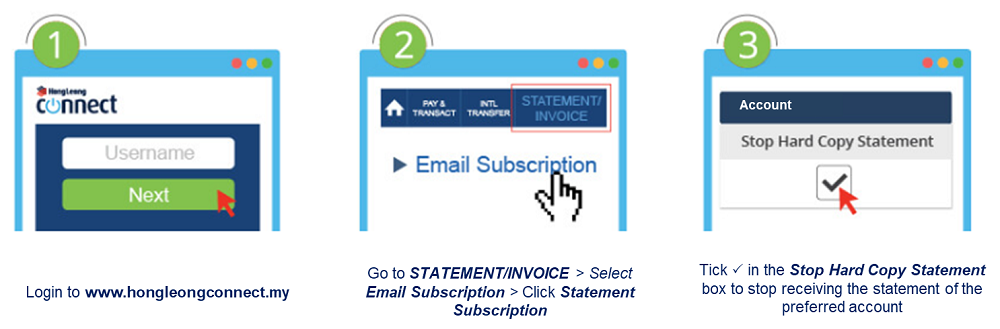

Step 2: Subscribe to e-Statement

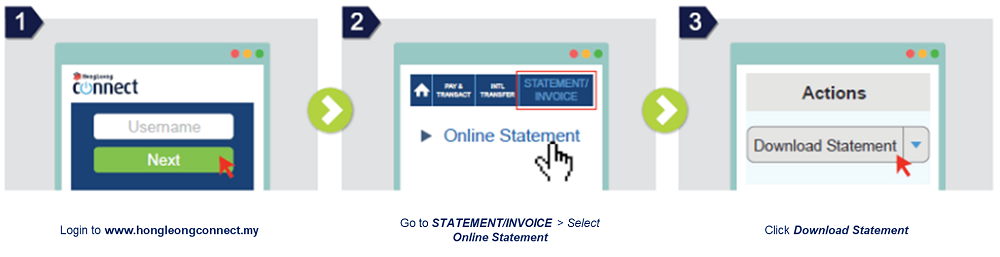

Step 3: Download and view e-Statement

Criteria for Exemption of Paper Statement Fee

If you fall into any of the following categories, you may be eligible for an exemption of the Paper Statement Fee:

Criteria |

Type of exemption |

Process of obtaining exemption |

|---|---|---|

Customers aged: 18 years and below and 60 years & above |

Auto exemption |

Paper statement fee will be waived automatically. |

Customers with difficulty in accessing e-Statements |

Manual exemption |

Required to submit a request with justification at the nearest HLB/HLISB Branch or reach out to Hong Leong Bank Interactive Phone Banking. Subject to approval. |

Customers with disabilities |

If you need assistance or have specific circumstances that require exemption, you can:

- call Hong Leong Bank Interactive Phone Banking at 03-76268899 (24 hours); OR

- visit our nearest HLB/HLISB branches

1. What is the Paper Statement Fee?

Effective March 2025, a RM2.00 fee will be charged for each paper statement you receive on a monthly or yearly basis for the following products:

i. Deposit/-i (except for Basic Savings Account/-i & Basic Current Account/-i)

ii. Property Loan/Financing-i

iii. Auto Loan/Financing-i

iv. Personal Loan/Financing-i

v. ASB Financing-i

2. Will I still receive my paper statement?

Yes, you will still receive your paper statement but starting from March 2025, a fee of RM2.00 will be charged for each paper statement you received and the fee will be debited from your account. As an alternative to receive your statement at ZERO COST, you may register for HLB Connect Online to have the access to e-Statement by referring to steps stated in Q9.

Meanwhile, for new customers, you are automatically enrolled for e-Statement during the account opening process. Should you wish to opt out from e-Statement enrolment & start to receive the paper statement, please visit our nearest HLB/HLISB branch for assistance.

3. How do I pay for the Paper Statement Fee?

This fee is automatically debited from your existing Deposit/-i and/or Loan/Financing-i account/s under fee & miscellaneous category. You may make the payment into the respective account directly.

4. Can I get a waiver/exemption on the Paper Statement Fee?

The Paper Statement Fee is not be applicable if you fall under any the following categories:

Criteria |

Type of exemption |

Process of obtaining exemption |

|---|---|---|

Customers aged: 18 years & below 60 years & above |

Auto exemption |

Paper statement fee will be waived automatically. |

Customers with difficulty in accessing e-Statement |

Manual exemption |

Please submit your request together with justification at any of the nearest HLB/HLISB branch or reach out to Hong Leong Bank Interactive Phone Banking at 03-7626 8899 (24 Hours). Subject to approval. |

Customers with disabilities |

5. I’m turning 60 this year. Is the exemption based on the year I was born or my birth date?

Fee exemption is based on the year you were born. If your birthday falls in the month of November, you will be exempted from the fee from January of the year you turned 60.

6. What is the required information to be submitted when I’m requesting for exemption of Paper Statement Fee?

- Full Name (as per NRIC/Passport)

- Reason(s) for request

- OKU Card (if applicable)

7. If my request for exemption of Paper Statement Fee is successful, will it be applicable permanently?

Yes, the exemption on the fee is permanent & you will continue to receive paper statement unless you switch to e-Statement.

8. Do I have an option to receive my statement at zero cost?

Yes. You are encouraged to switch to electronic statement (e-Statement) at ZERO COST. Please refer to the e-Statement FAQ for further details.

9. How do I sign-up & access my e-Statement?

- Step 1: Register HLB Connect Online

- Step 2: Subscribe to e-Statement

- Step 3: Download and view e-Statement

If you need assistance or have specific circumstances that require exemption, you can:

- call Hong Leong Bank Interactive Phone Banking at 03-7626 8899 (24 hours); OR

- visit our nearest HLB/HLISB branches

10. When will I start receiving my e-Statement via email if I enroll now?

You will receive your first e-Statement via your registered email address starting from your next statement date.

11. Will I be able to save my e-Statements?

Yes, you can save your e-Statement by downloading it into your electronic storage devices.

12. How long will my e-Statement be available for viewing in HLB Connect Online?

e-Statements will be available for viewing and download in HLB Connect Online for the latest 24 months + 1 month (current month).